|

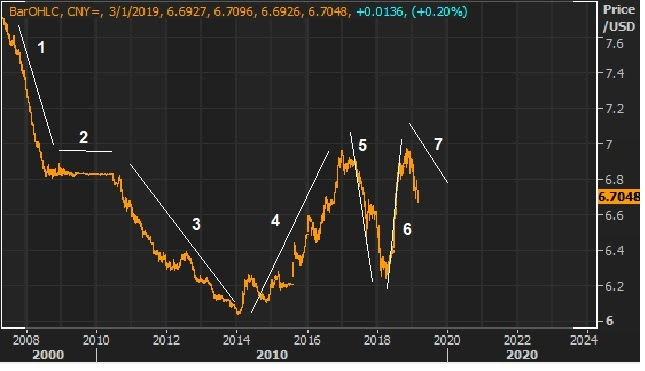

May 17, 5:00 pm EST China continues to move their currency lower, as a way to offset some of the burden of tariffs (reducing the price of Chinese products in dollar terms). And we’ve seen how the trajectory of the yuan is effecting Bitcoin. Chinese citizens are trying to get their money out and doing so through Bitcoin. Let’s take a look at how it is effecting the price of gold. As you can see in the chart, the yuan and the price of gold have traded in a fairly close relationship.

|

|

|

Of course, there are a lot of unconventional economic times incorporated in this chart (from 2006-present) — like a flight to safety in the financial crisis, which was bullish for gold. But is there anything behind the yuan – gold relationship? It seems so. As we know the Chinese has managed the value of their currency relative to the U.S. dollar for a long time (the currency of its biggest trading partner, the global reserve currency and the global currency of trade). From 1996 to 2005, China pegged the currency at 8.28 to the dollar. In 2005, they went to a managed float (to pacify WTO requirements and U.S. demands), where they allowed for a gradual strengthening of the yuan. But it also seems clear that they have managed it to the value of gold. As they weaken the yuan, they reduce their buying power of gold (i.e. their ability to print yuan, sell it for dollars and buy gold – not to mention other commodities). So manipulating the price of gold to preserve the yuan’s buying power is plausible. If we think to the behavior of gold while China was running the currency peg from 1996 to 2005: Gold was in a sideways range the entire time. Only when they moved to a managed float in 2005, strengthening the yuan, did the price of gold finally break out of the sideways range of the prior decade (higher, along with the yuan). With the above in mind, as China continues to walk the yuan lower, we may find the price of gold making another run toward the $1,000 level. If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here. |