|

|

June 4, 5:00 pm EST We’ve talked about the build up to a Fed rate cut. On that note, we heard from the Fed Chair this morning (more in a moment). As we’ve discussed, the market has been bullying the Fed for a rate cut, with a 10- year yield sitting near the lowest levels since late 2017 – almost 120 basis points lower than the levels of just six months ago. Here’s what that looks like on a chart … |

|

|

For perspective, the last time the U.S. 10-year government bond yield (the benchmark “market determined” interest rate) was here, the Fed determined benchmark interest rate was only 1.25%. The Fed is now at 2.50%.

Is the Fed listening to the message from the interest rate market? The good news: It seems so. We’ve heard from Fed officials (yesterday and today), acknowledging that they (the Fed) have the flexibility (with low and tame inflation) to cut rates as an insurance policy against an economic slowdown. The Fed Chair himself said as much this morning in prepared remarks for his scheduled speech at a Chicago Fed conference. Here’s what he said… “I’d like first to say a word about recent developments involving trade negotiations and other matters. We do not know how or when these issues will be resolved. We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion…” So, we had a tone-deaf Fed in December, hiking rates into falling stock markets and growing global economic risks. And now it appears the Fed is hearing more clearly. With that, we get a big bounce back in stocks over the past 24-hours. And, importantly, the S&P 500 has recovered back above the 200-day moving average (the purple line). |

|

|

And, as you can see in the chart of 10-year yields above, we’re also getting big technical support at the lows yesterday in interest rates. Both charts support the scenario of recovery/bounce.

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here. |

June 3, 5:00 pm EST

Back on December 19th, the Fed hiked rates into a sharply falling stock market. This turned out be the last rate hike in its “rate normalization program.”

Here’s an excerpt from my Pro Perspectives note from December 19th, following the Fed meeting:

“This sets up for what looks like an ugly finish for the year. Remember, as we discussed on Monday, we talked about the similarities to 1994. The Fed, back in 1994, was also

This is the first time since 1994 that stocks, bonds, real estate and gold have all been losers on the year (negative returns). And the first time cash has been the highest return asset class. As we discussed,the Fed had to reverse course and cut rates in 1995, which finally unleashed the stock market, which finished up 36% that year.

Bottom line: The Fed has been, by their own admission, walking a tightrope trying to raise rates without killing the recovery. They now clearly have signals, in the plunge in stocks and oil prices, that they may have gone too far.“

Fast forward to today, and the markets have clearly signaled that the Fed made a mistake (at least) with the last rate hike.

With that, the rate cut chatter is now loud. The interest rate market is pricing in a 60% chance of a cut at the July meeting. And we’re now hearing more and more aggressive projections for where the Fed will take rates by year end. Barclay’s thinks they will cut three times this year. That’s anticipating a lot of economic deterioration.

Still, with that extreme viewpoint out there, the market is still underpricing the chance of a rate cut this month — at the Fed’s June meeting on the 19th. That sets up for a surprise.

And we may get some signals tomorrow, as Jerome Powell is scheduled for a prepared speech at a Chicago Fed conference (9:55 EST). Interestingly, the conference is called “Fed Listens.” Let’s see how well they are listening to markets.

It’s not uncommon for the Fed to float some policys shift balloons. We saw plenty of it in January, when they went on a public campaign to make clear to markets that they were done with interest rates hikes. They have since moved to a neutral stance. Today we Jim Bullard — St. Louis Fed President, a voting member — say a cut may be “warranted soon” to “provide some insurance” in case of a sharper slowdown.

The 10-year yield seems to keep bleeding lower, forcing the Fed’s hand. The 10-year yield is now 43 basis points below the top end of the Fed Funds target range (2.25 to 2.50%).

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here.

|

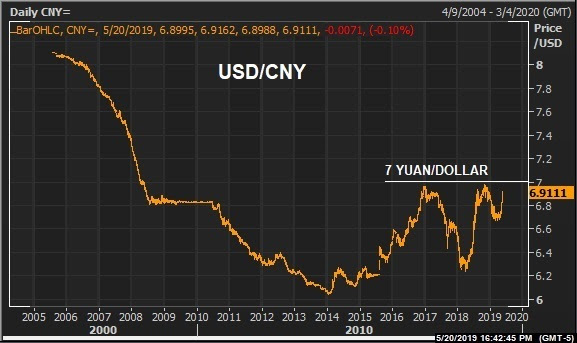

May 31, 5:00 pm EST We end the month of May today. Things were going quite well for markets, with stocks sitting on record highs, until Trump did this over the first weekend of the month …

|

|

|

With the above in mind, let’s look back at my May 6th note: “Why would Trump risk complicating a deal, even more, by threatening China with a deadline/tariff increase? Because he has leverage. He has a stock market near record highs, and a strong economy and the winds of ultra-easy global monetary policy at his back … So, Trump has a win–win going into the week. If the threat works, he gets a deal done, and likely gives less to get it done. If China backs off, stocks go down, and he gets the Fed’s rate cut he’s been looking for–stocks go back up.” As we know, China walked. And Trump is now using a similar position of strength to influence policy with Mexico. As such, stocks have now fallen nearly 7% from the highs. And the prospects for a Fed rate cut are looking very strong. How strong? The interest rate market is pricing in a 90% chance of a rate cut by year end, and a 60% chance of a two rate cuts. But despite the sharp decline in global interest rates, the market seems to be well underestimating the chances for a Fed rate cut this month — at the June 19 Fed meeting. There are two clear influences on Fed policy over the past few years. Stocks and crude oil. The latter weighs on inflation. While the Fed claims to ignore the influence of food and energy in their inflation measure, they have a history of acting when oil moves sharply. And inflation is already running at very soft levels. On that note, what was the biggest loser for the day, week and month? Crude oil. Crude was down 7.5% today, 10% for the week, and 16% for the month. If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential. Join now and get your risk free access by signing up here. |

May 30, 5:00 pm EST

The first revision of Q1 GDP came in this morning, in-line with expectations (at 3.1%). As yields swoon, and stocks have given back some gains for the month, this growth number today is good reminder that the state of the U.S. economy is good.

Remember, back in April, the first look at Q1 GDP came in as a huge positive surprise (at 3.2%). Many were expecting it to be a terrible quarter. Goldman Sachs thought the quarter would produce just 0.7% growth. They were wrong, and they weren’t alone. At the end of the first quarter, the Atlanta Fed’s GDP model was estimating that the economy grew at only 0.3% in Q1.

With that in mind, don’t get too caught up in the souring growth story. At the moment, the consensus view on Wall Street is for Q2 growth to come in at 1.8%. And the Atlanta Fed model is looking for 1.3%. Both are well lower than the White House envisioned 3%+ growth trend.

But, for perspective, there are some clear factors working in favor of the higher (not lower) growth case.

The job market is strong. We have monthly new jobs running at a 12-month average of 218k. That’s well above pre-financial crisis average monthly job growth. The unemployment number at 3.6% is the lowest since 1969.

Most importantly: Wage growth has been on the move for the past 18 months, now sustaining above 3%. And Q1 productivity came in at 3.6%, the hottest productivity reading in almost a decade. The economy can grow by expanding the size of the workforce or the productivity of the workforce. We’re finally getting solid productivity growth.

|

May 29, 5:00 pm EST We’ve talked about the signal the interest rate market is giving: with rates at these levels, the bond market may force the Fed’s hand — forcing a June rate cut. Still, the slide in the 10-year yield from 2.75 (in March) to 2.20 (the low today) is well overstating the risks in the global economy. That’s more than 100 basis points off of the highs of just six months ago. And the high to low of the last five trading days has been almost a full quarter point (23 basis points). It makes no sense. Many would assume it’s related due to the trade standstill. But the IMF has only cut its growth estimate by 3/10ths of a percent from the tariff escalations. That still projects a 3% growth from the global economy (much better than the average of the past 10-years). Meanwhile, a U.S. 10-year and 2.20%, and German and Japanese yields well in negative territory are pricing in global recession (if not worse). Is Japan buying U.S. Treasuries, and therefore pushing down global yields? Maybe. As we know, the slide in yields has weighed on confidence, and therefore stocks for the month of May. But today, we ran into a huge technical level in the S&P 500 — the 200-day moving average. And we had a big bounce. I suspect we’ve seen the bottom of this move in stocks and yields. We shall see.

|

|

|

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential. Join now and get your risk free access by signing up here. |

|

May 28, 5:00 pm EST We head into the last week of May, with major global stock markets down in the neighborhood of 5% for the month. And with major global interest rates at the lowest levels since late 2016-2017. With this in mind, let’s revisit how we opened the month of May. On May 1, U.S. stocks had just put up the best opening four months since 1999. But the interest rate market was continuing signal that the Fed had made a mistake in its rate hiking campaign — specifically the December rate hike. On a related note, we closed the first day of May with a sharp sell off in stocks, and we looked at this chart …

|

|

|

As you can see, the S&P 500 put in a big technial reversal signal — a bearish outside day. With this technical setup, I said in my May 1 note: “you have to ask the question: Can stocks force the hand of the Fed, again?” … i.e. can a lower stock market force the Fed to cut rates — to take back the December mistake. Here we are, twenty-seven days later, and stocks are down about 5%. That reversal signal did indeed predict the decline. But the decline hasn’t been messy like the slides of the fourth quarter. It has been orderly, and I suspect it’s not forcing the Fed’s hand. But, what may force the Fed’s hand is the the bond market. Consider this, the last time U.S. 10-year government bond yield was at these levels, 2.25%, the Fed Funds rate was HALF of current levels (1.25% in Q3 of 2017 versus 2.5% today). This disconnect between what the market judges to be the appropriate interest rate and what the Fed judges the appropriate level, is causing the dreaded yield curve inversion signal that is scaring markets. If things stay here, that’s probably good enough for a June (19) rate cut. If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential. Join now and get your risk free access by signing up here. |

|

|

|