|

May 9, 5:00 pm EST

Yesterday we talked about the tool China will use to offset tariffs, if a deal does not materialize and the tariff penalty increases.

They will devalue their currency.

With a “no deal” potential outcome, there’s a lot of wealth in China looking for ways out.

In recent years, they have found a way out through Bitcoin. And, no coincidence, Bitcoin is again on the move.

With that, let’s take a look at the timeline on Bitcoin…

The 2016-2017 ascent of Bitcoin coincided perfectly with the crackdown on capital flight in China. In late 2016, with rapid expansion of credit in China, growing non-performing loans, a soft economy and the prospects of a Trump administration that could put pressure on China trade, capital was moving aggressively out of China.

That’s when the government stepped UP capital controls — restricting movement of capital out of China, from transfers to foreign investment.

Of course, resourceful Chinese still found ways to move money. Among them, buying Bitcoin. And that’s when Bitcoin started to really move (from sub-$1,000 to over $19,000). China cryptocurrency exchanges were said to account for 90% of global bitcoin trading.

Chinese capital flows were confused for Silicon Valley genius.

But in late 2017, China cracked down on Bitcoin – with a total ban. A few months later, Bitcoin futures launched, which gave hedge funds a liquid way to short the madness. Bitcoin topped the day the futures contract launched.

So, as Chinese officials visit the White House for a deal or no deal on trade, China has been moving their currency lower — and bitcoin has (again) been moving higher. Perhaps the Chinese are finding new ways to buy Bitcoin.

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here.

|

April 9, 5:00 pm EST A key piece in the continuation of the global economic recovery will be a weaker dollar. It will drive a more balanced U.S. and global economy, and it will reflect strength in emerging markets (i.e. capital flows to emerging markets). To this point, as we’ve discussed, higher U.S. rates have meant a stronger dollar. With global central banks moving in opposite directions in recent years, capital has flowed to the United States. But the emerging markets have suffered under this dynamic. As money has moved OUT of emerging market economies, their economies have weakened, their currencies have weakened, and their foreign currency denominated debt has increased. But now we have a retrenchment from the Fed. And we have coordinated global monetary policy (facing in the same direction). This sets up to solidify a long-term bear market for the dollar. Let’s take a look at a couple of charts that argue the long-term trend is already lower, and the next leg will be much lower. First, here’s a revisit of the long-term dollar cycles, which we’ve looked at quite a bit in this daily note. Since the failure of the Bretton-Woods system, the dollar has traded in six distinct cycles – spanning 7.6 years on average. Based on the performance and duration of past cycles, the bull cycle is over, and the bear cycle is more than two years in. |

|

|

With this in mind, if we look within this current bear cycle, technically the dollar is trading into a major resistance area – a 61.8% retracement. The next leg should be lower, and for a long period of time. |

|

|

Trump wants a weaker dollar, and I suspect he’s going to get it.

Sign up to my Billionaire’s Portfolio and get my market beating Billionaires Portfolio … Live Portfolio Review conference calls … Weekly notes with updates and specific recommendations on following the best billionaire investors … Access to my member’s only area on the Billionaire’s Portfolio. Plus, my blog — full of information that will set you apart from other average investors. Join now and get your risk free access by signing up here. |

|

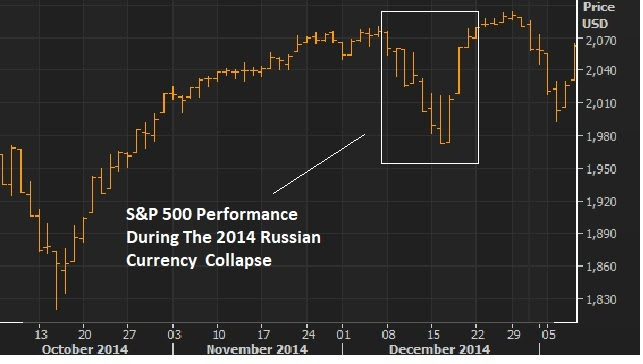

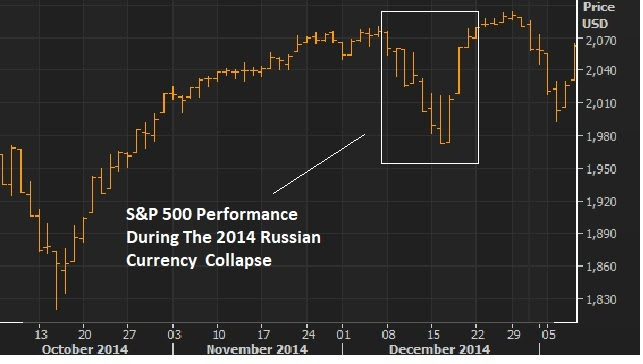

August 16, 5:00 pm EST On Tuesday, we looked at the similarities between the recent currency collapse in Turkey, and the 2014 collapse of the Russian ruble. And we looked at this chart of how the S&P 500 behaved back in 2014. |

|

|

The S&P 500 is the proxy on global market stability. And stocks were shaken on Russia back in 2014. When the ruble collapsed, U.S. stocks lost 5% of its value in just 7 days. But the decline was fully recovered in just 3 days. Given the similarities of these two currency crises (a currency attack on a bad behaving leader), I thought we might see the same behavior in stocks this time. And that’s what we appear to be getting – a shallower decline but a swift recovery. So, why the quick recovery? As we also discussed on Tuesday, while the Turkish lira has been the center of attention in the financial media, the real reason global markets were shaking had more to do with China. If a currency crisis that started in Turkey ended in China, there would be big geopolitical fallout. As we’ve discussed over the past month, the biggest risk from China is a big one-off devaluation. That would stir up a response from other big trading partners (i.e. Europe and Japan), where they would likely coordinate to block trade from China all together. That’s where things would get very ugly and likely (ultimately) culminate in a military war. But the probability of that outcome was reduced yesterday. We had news that a China delegation would travel to the U.S. to re-open trade negotiations. They’re coming back to the table. So we should expect concessions from China. That’s good news for the globlal economy and for global stability. And that news drove the big bounce in stocks yesterday, which continued today. I suspect this will be the catalyst to get stocks back on the path toward a double-digit gains by year-end. If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here. |

|

August 14, 5:00 pm EST We talked yesterday about the sharp currency devaluation in Turkey over the past few days. The Lira bounced aggressively today, which soothes some fears in global markets. As I said, many have made comparisons to the Asian currency crisis of the late 90s, and have speculated on the potential for the events in Turkey to ultimately destabilize global markets. But as we discussed yesterday, this looks more like the 2014 currency attack on the Russian ruble — a geopolitically-driven crippling of an economy with bad behaving leadership. With that in mind, here’s what happened to U.S. stocks back in 2014, when the ruble lost 5% of its value (vs the dollar) in just 7 days. But the decline was fully recovered in just 3 days. |

|

|

U.S. stocks have been the proxy for global market stability throughout the past decade (the crisis and post-crisis era). So, for perspective on just how shaky the Turkey influence is being perceived, the S&P 500 sits just one percent off of all-time highs at today’s close. Remember, the ECB stands ready to plug any holes necessary in European bank exposure to Turkish debt. That euro-denominated debt has been the risk people immediately homed in on. The real question is, will this (currency crisis) ultimately end in China, with a revaluation of the yuan, or perhaps a free-floating yuan? |

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here. |

May 26, 2017, 2:30pm EST Invest Alongside Billionaires For $297/Qtr

The past few days we’ve looked at the run up in bitcoin. Remember, I said: “If you own it, be careful. The last time the price of bitcoin ran wild, was 2013. It took about 11 days to triple, and about 18 days to give it all back. This time around, it’s taken two months to triple (as of today). ”

It looks to be fueled by speculation, and likely Chinese money finding its way out of China (beating capital controls). And yesterday we talked about the potential disruption to global markets that could come with a crash in bitcoin prices.

I suspect that’s why gold is finally beginning to move today, up almost 1%, and among the biggest movers of the day as we head into the long holiday weekend (an indication of some money moving to gold to hedge some shock risk).

Remember yesterday we looked at the chart on Chinese stocks back in 2015 and compared it to bitcoin. The speculative stock market frenzy back thin was pricked when the PBOC devalued the yuan later in the summer.

Probably no coincidence that bitcoin’s recent acceleration happened as Moody’s downgraded China’s credit rating this week for the first time since 1989 (an event to take note of). Yesterday, the PBOC was thought to be in buying Chinese stocks (another event to take note of). And this morning, the PBOC stepped in with another currency move! Historically, major turning points in markets tend to come with some form of intervention. Will a currency move be the catalyst to end the bitcoin run, as it did the runup in Chinese stocks two years ago?

Let’s take a look at what the currency move overnight means …

Keep in mind, the currency is China’s go-to tool for fixing problems. And they have problems. The economy is crawling around recession like territory. The debt was just downgraded. And they’ve had a tough time managing capital flight. As an easy indicator: Global stocks are soaring. Chinese stocks are dead (flat on the year).

Remember, their rapid economic ascent in the world came through exports (via a weak currency). The move overnight is a move back toward tying its currency more closely to the dollar. Which, if this next chart plays out, will also weaken the yuan compared to other big exporting competitors in the world.

That should help the Chinese economic outlook, which may help stem the capital flight (which has likely been a significant contributor to bitcoin’s rise).

February 7, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

Yesterday we looked at the slide in yields (U.S. market interest rates — the 10-year Treasury yield). That continued today, in a relatively quiet market.

Let’s take a look at what may be driving it.

If you take a look at the chart below, you can see the moves in yields and gold have been tightly correlated since election night: gold down, yields up.

As markets began pricing in a wave of U.S. growth policies, in a world where negative interest rates were beginning to emerge, the benchmark market-interest-rate in the U.S. shot up and global interest rates followed. The German 10-year yield swung from negative territory back into positive territory. Even Japan, the leader of global negative interest rate policy early last year, had a big reversal back into positive territory.

And as growth prospects returned, people dumped gold. And as you can see in the chart above of the “inverted price of gold,” the rising line represents falling gold prices.

Interestingly, gold has been bouncing pretty aggressively since mid December. Why? To an extent, it’s pricing in some uncertainty surrounding Trump policies. And that would also explain the slow down and (somewhat) slide in U.S. yields. In fact, based on that chart above and the gold relationship, it looks like we could see yields back below 2.10%. That would mean a break of the technical support (the yellow line) in this next chart …

Another reason for higher gold, lower yields (i.e. higher bond prices), might be the capital flight in China. Where do you move money if you’re able to get it out in China? The dollar, U.S. Treasuries, U.S. stocks, Gold.

The data overnight showed the lowest levels reached in the countries $3 trillion currency reserve stash in 6 years. That, in large part, comes from the Chinese central banks use of reserves to slow the decline of their currency, the yuan. Of course a weakening yuan only inflames U.S. trade rhetoric.

For help building a high potential portfolio for 2017, follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio more than doubled the return of the S&P 500 in 2016. You can join me here and get positioned for a big 2017.