|

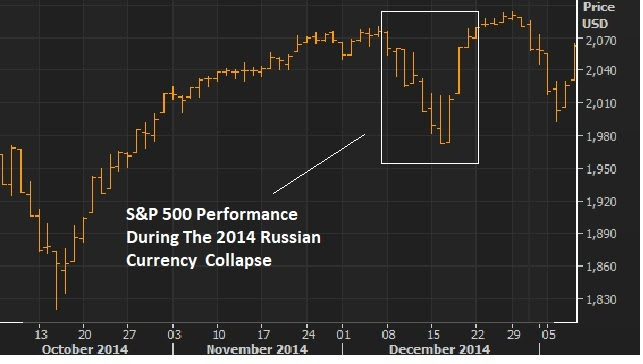

August 14, 5:00 pm EST We talked yesterday about the sharp currency devaluation in Turkey over the past few days. The Lira bounced aggressively today, which soothes some fears in global markets. As I said, many have made comparisons to the Asian currency crisis of the late 90s, and have speculated on the potential for the events in Turkey to ultimately destabilize global markets. But as we discussed yesterday, this looks more like the 2014 currency attack on the Russian ruble — a geopolitically-driven crippling of an economy with bad behaving leadership. With that in mind, here’s what happened to U.S. stocks back in 2014, when the ruble lost 5% of its value (vs the dollar) in just 7 days. But the decline was fully recovered in just 3 days. |

|

|

U.S. stocks have been the proxy for global market stability throughout the past decade (the crisis and post-crisis era). So, for perspective on just how shaky the Turkey influence is being perceived, the S&P 500 sits just one percent off of all-time highs at today’s close. Remember, the ECB stands ready to plug any holes necessary in European bank exposure to Turkish debt. That euro-denominated debt has been the risk people immediately homed in on. The real question is, will this (currency crisis) ultimately end in China, with a revaluation of the yuan, or perhaps a free-floating yuan? |

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here. |