|

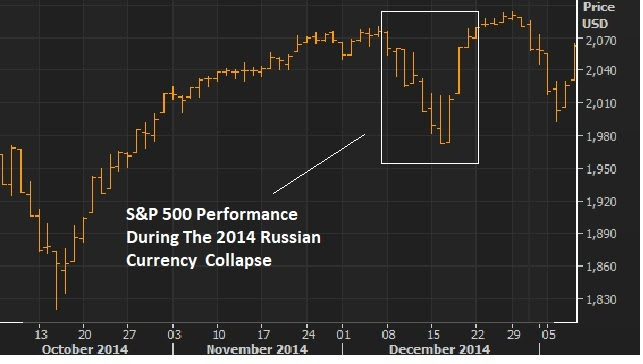

August 16, 5:00 pm EST On Tuesday, we looked at the similarities between the recent currency collapse in Turkey, and the 2014 collapse of the Russian ruble. And we looked at this chart of how the S&P 500 behaved back in 2014. |

|

|

The S&P 500 is the proxy on global market stability. And stocks were shaken on Russia back in 2014. When the ruble collapsed, U.S. stocks lost 5% of its value in just 7 days. But the decline was fully recovered in just 3 days. Given the similarities of these two currency crises (a currency attack on a bad behaving leader), I thought we might see the same behavior in stocks this time. And that’s what we appear to be getting – a shallower decline but a swift recovery. So, why the quick recovery? As we also discussed on Tuesday, while the Turkish lira has been the center of attention in the financial media, the real reason global markets were shaking had more to do with China. If a currency crisis that started in Turkey ended in China, there would be big geopolitical fallout. As we’ve discussed over the past month, the biggest risk from China is a big one-off devaluation. That would stir up a response from other big trading partners (i.e. Europe and Japan), where they would likely coordinate to block trade from China all together. That’s where things would get very ugly and likely (ultimately) culminate in a military war. But the probability of that outcome was reduced yesterday. We had news that a China delegation would travel to the U.S. to re-open trade negotiations. They’re coming back to the table. So we should expect concessions from China. That’s good news for the globlal economy and for global stability. And that news drove the big bounce in stocks yesterday, which continued today. I suspect this will be the catalyst to get stocks back on the path toward a double-digit gains by year-end. If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here. |