|

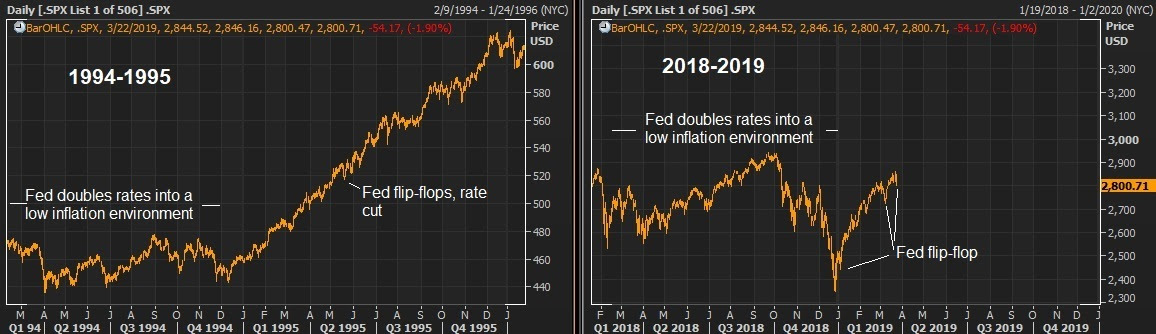

June 11, 5:00 pm EST Yesterday we talked about the surgical manipulation Trump is (seemingly) attempting to perform, to force the Fed’s hand on a rate cut — and therefore, to optimize the economy heading into the election. At this stage, the harder he is on China, the lower stocks go, which puts more pressure on the Fed to cut rates. But as the Fed has now signaled it’s prepared to act, stocks have risen, which makes it less likely that the Fed will act. With that, yesterday, I surmised that Trump might ramp up the rhetoric as we near the June 19th Fed meeting, to keep a lid on the bounce in stocks. On that note, Trump had some very firm comments on China trade this morning, implying he’s not willing to give any ground. He says “we’re going to either do a great deal with China or we’re not doing a deal at all.” He gets his demands, or no deal. Again, as we discussed yesterday, he’s in the driver’s seat. And he said as much today: “It’s me right now that’s holding up the deal.” Stocks have given some back today, after a six day rally from the lows of this recent correction. And we get this chart going into the close…

|

|

|

As you can see, the S&P 500 put in a big technical reversal signal — a bearish outside day. The last signal like this we observed was on May 1, which resulted in a 7.6% correction. Perhaps we have a signal here of some softness in stocks to come, until we get to the June 19 Fed meeting.

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential. Join now and get your risk free access by signing up here. |