|

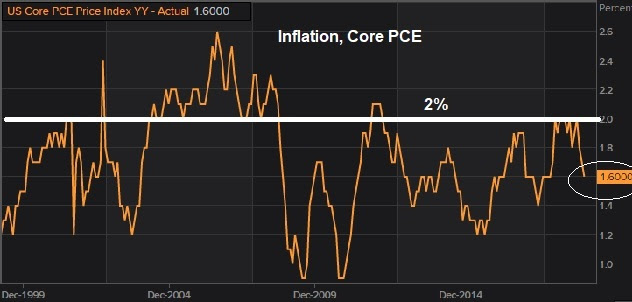

April 29, 5:00 pm EST We ended last week with a positive surprise for Q1 GDP. Today, we had more soft inflation data. The Fed’s favored inflation gauge, core PCE, continues to fall away from it’s target of 2%. Here’s a look at the chart …

|

|

|

With a Fed meeting this week, they remain in the sweet spot. They have trend economic growth, subdued inflation and a 10-year yield at 2.5%. They can sit and watch. They could cut! That’s highly unlikely, but less unlikely by the summer, if current conditions persist. The market is pricing in about a 60% chance that we’ll see a rate cut by year-end. It doesn’t sound so crazy, if you consider that it would underpin/if not ensure the continuation of the economic expansion — perhaps even fueling an economic boom period. Remember, we’ve talked about the 1994-1995 parallels. In 1994, an overly aggressive Fed raised rates into a recovering, low inflation economy. By 1995, they were cutting. That led to a 36% rise in stocks in 1995. And it led to 4% growth in the economy through late 2000 — 18 consecutive quarters of 4%+ growth. Stocks tripled over the five-year period. This, as the S&P 500 is already sitting on new record highs? As I said earlier this year, with yields back (well) under 3%, we should see multiples on stocks expand back toward 20x in this environment. The forward 12-month P/E on the S&P 500 is currently 16.8. If we multiply Wall Street’s earnings estimate on the S&P 500 ($175) times a P/E of 20, we get 3,500 in the S&P 500. That’s 19% higher than current levels. But keep in mind, the earnings estimate bar has been set low. And already 77% of companies are beating estimates on Q1 earnings. I suspect, we’ll see higher earnings over the next twelve months than Wall Street has estimated, AND a higher multiple paid on those earnings (i.e. an outlook for an S&P 500 > 3,500). If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential. Join now and get your risk free access by signing up here. |