January 28, 5:00 pm EST

This is a huge week. We’re following a down 9% month for stocks with a big bounceback. But it will all hinge on the events of the week.

We get Q4 earnings from about quarter of the companies in the S&P 500 – and a third of the Dow. We have the Fed on Wednesday. And the U.S. hosts trade talk meetings with China on Wednesday and Thursday. And then on Friday, we’ll get the jobs report.

We kicked off earnings season with reports from the big banks two weeks ago. And the reports broadly painted the picture of a healthy consumer and healthy economy.

This week, we hear from a broad swath of blue chips, including big multinational businesses. Among them: We heard from Caterpillar today. We’ll hear from Apple and Boeing tomorrow. McDonalds and 3M report on Wednesday. Amazon is on Thursday.

Expect a lot of discussions about “concerns” on the outlook (as we heard from Caterpillar today), but with a picture about Q4 that looked good (continuing with the theme of 2018).

Remember, much of the talk about slowdown has been about what might happen, in the year (or two) ahead – which primarily assumes a long-term stalemate on the Trump trade war. With that, never underestimate Wall Street and corporate America’s willingness to set the bar low (when given the opportunity), so that they can jump over a very low bar (i.e. set up for earnings beats in future quarters).

Far more important than those “concerns” voiced by CEO’s, is what the Fed has already done, and what will come out of the U.S./China talks this week.

Remember on January 4th, the Fed responded to the calamity in financial markets by backing down from their rate hiking plans. This week, the Fed Chair will likely use his post-meeting press conference to further massage markets. The Fed, the ECB and the BOJ have already positioned themselves (in recent weeks) to be the shock absorbers if the trade war continues to drag out.

As for trade talks, the calendar continues to approach the March 1 deadline on the tariff truce. And China has been gasping for air. I suspect we will get progress — maybe an official agreement on trade, leaving the intellectual property and technology transfer negotiations still on the table. That would be good progress.

Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

December 14, 5:00 pm EST

We’ve talked about the struggling Chinese economy this week.

As I’ve said, much of the key economic data in China is running at or worse than 2009 levels (the depths of the global economic crisis).

And the data overnight confirmed the trajectory: lower.

As we’ve discussed, this lack of bounce in the Chinese economy (relative to a U.S. economy that is growing at better than 3%) has everything to do with Trump squeezing China.

He acknowledged it today in a tweet ….

The question: Has China retaliated with more than just tit-for-tats on trade? Have they been the hammer on U.S. stocks? It’s one of the few, if not only, ways to squeeze Trump. As we discussed last week, when the futures markets re-opened (at 6pm) on the day of mourning for the former 41st President, there was a clear seller that came in, in a very illiquid period, with an obvious motive to whack the market. It worked. Stocks were down 2% in 2 minutes. The CME (Chicago Mercantile Exhange) had to halt trading in the S&P futures to avert a market crash at six o’clock at night.

Now, cleary stocks have a significant influence on confidence. You can see confidence wane, by the day, as stocks move lower. And, importantly, confidence fuels the decisions to spend, hire and invest. So stock market performance feeds the economy, just as the economy feeds stock market performance. The biggest threat to a fundamentally strong economy, is a persistently unstable stock market. In addition, sustaining 3% growth in the U.S. will be difficult if the rest of the world isn’t participating in prosperity.

With that in mind, in my December 1 note, I said “it may be time for Trump to get a deal done (with China) and solidify the economic momentum needed to get him to a second term, where he may then readdress the more difficult structural issues with China/U.S. relations.” That seems even more reasonable now.

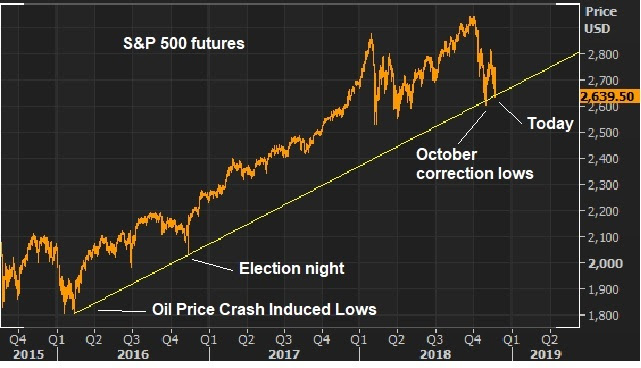

We end the week with this chart of the S&P.

We have two 12% declines in stocks this year. And you can see the fear beginning to set in. With that, the best investors in the world have made their careers by “being greedy when others are fearful” (Warren Buffett) or “buying when most people are selling and selling when most people are buying” (Howard Marks). There is clear value in stocks right now.

Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.