December 7, 5:00 pm EST

Last year, the stock market broke a 21-year old record of the most consecutive days without a 3% intraday drawdown — some 240+ straight days.

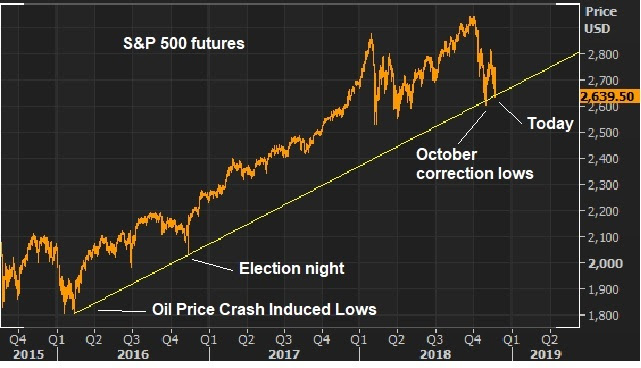

We’ve now had a 3% intraday drawdown (open to low) three times since just early October.

So, what is responsible for the rise in volatility? Why such a contrast from last year?

It’s regime change. After nine years of zero interest rates and trillions of dollars of QE, the torch was passed this year. We entered the year with big tax cuts to implement.

This was the official transition from a monetary policy-driven economic recovery, to a fiscal stimulus-driven recovery. The Fed passed the economic stimulus torch to the White House.

Now, there was good reason that volatility remained subdued under the Fed’s emergency level zero-interest-rate policy. Why? The Fed told us, explicitly, that they (and other major global central banks) stood “ready to act” against any potential shocks that could disrupt the global economic recovery. That was an explicit promise to absorb risks so that investors (businesses, consumers, etc) would keep economic activity moving, by spending, hiring and investing.

The Fed (and other central banks, namely the ECB) had to be the backstop, so that people would pursue higher risk/return assets, in a world where risk-free assets yielded nothing. That was good enough to secure an economic recovery, but only at stall-speed levels of growth.

With that, as we entered the year, the U.S. economy was, for the first time in more than nine years, removing the central bank backstop (removing the life support for the economy). The gameplan: To replace low interest rates and QE with a $1.5 trillion fiscal stimulus package to catapult the economy out of the economic rut of 1% growth, and back toward sustainable 3% (trend) growth. And with that influence, the economy might have a chance to sustainably mend and breath on its own again.

So far we’ve gotten the growth (whether or not it’s sustainable has yet to be seen). But this regime change has also introduced uncertainty (and shock risks) back into the economy and markets. That resets the scale on volatility. And I think that adjustment has been underway.

With that said, the pendulum often swings a little too far in the opposite direction at first (from little-to-no volatility to a lot, in this case).

What stocks do you buy? Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

December 5, 5:00 pm EST

I was away from the markets yesterday, on a big down day. With markets closed today to honor the 41st President, let’s take a look at what happened on Tuesday.

Why the ugly and persistent plunge in stocks?

Many of the reasons that have been attributed to the two stock market corrections this year, bubbled up again yesterday. But as we’ve discussed, the stock declines this year appear to have had everything to do with Saudi capital flows–and less to do with all of the hand-wringing issues you hear and read in the financial media. Same can be said for yesterday.

When prospects rise that Saudi assets may be threatened by sanctions(or seizures in the case earlier this year, related to the Crown Prince’s corruption crackdown) indiscriminate and aggressive selling of U.S. assets hit immediately (likely led by the Saudi sovereign wealth fund, which has assets over half a trillion dollars).

We had it again yesterday. Stocks had a big gap up on Monday on movement on U.S./China trade. It was after the close on Monday that the news hit that the CIA would brief the special Senate committee on Tuesday. Stocks immediately started moving lower. The Dow futures were down 250 points by midnight. And then of course, yesterday, when news hit that the briefing was underway (just after noon), the bottom immediately fell out of stocks. A little more than half an hour later, U.S. Senators were standing in front of cameras telling the world that the Crown Prince was involved in the murder and that Congress should invoke the Magnitsky Act. This law authorizes the government to sanction human rights offenders, freeze their assets, and ban them from entering the U.S.

That sounds ominous for the Crown Prince.

But the Magnitsky Act comes in the form of a request from Congress, and the President has the discretion to act or not (but must decide within 120 days).

With that, I suspect this was nothing more than grandstanding. Trump will not (can not) act for the reasons we discussed last month.

From a security standpoint, Saudi Arabia is a critical alliance in the fight to defeat ISIS and check of Iran. Maybe more importantly, pushing Saudi Arabia toward an alignment with China and Russia in the long game would be a grave danger for the U.S.

Taking action against the Crown Prince would jeopardize both.

So, as I said last month, Trump has been leveraging the Saudi crisis to get oil prices lower. And he’s gotten it – to the tune of a 35% decline in oil prices. And to this point, it appears Trump has settled on the sanctions that have already been levied already on Saudi individuals involved in the Khashoggi murder (which don’t include the Crown Prince).

If he sanctioned the Saudi government over this, oil prices would probably explode and stocks would crash (not really an option).

We’ll see how stocks react tomorrow after a day of reflection. I suspect Tuesday created another buying opportunity.

What stocks do you buy? Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

Today I want to talk about the decline in Bitcoin.

As we often see with markets, people tend to confuse forced capital flows with genius.We’ve seen it in the tech giants. The “disrupters” in Silicon Valley were only able to disrupt long-entrenched industries because of the hundred billion dollars that flowed from Washington to Silicon Valley as part of the American Recovery and Reinvestment Act. When the government is pouring that kind of money into “new technologies”, private equity (i.e. pension fund money) will follow it. Plenty of funding, regulatory advantage, and no pressure to (in some cases, ever) produce a profit turns out to be a recipe for destroying industries. The entrepreneurs are credited for their genius, but they have those capital flows from Washington, at the depths of the economic crisis, to thank for it.

Bitcoin is another case of confusing capital flows with genius. It’s no coincidence that the ascent of Bitcoin coincided perfectly with the crackdown on capital flight in China. In late 2016, with rapid expansion of credit in China, growing non-performing loans, a soft economy and the prospects of a Trump administration that could put pressure on China trade, capital was moving aggressively out of China. That’s when the government stepped UP capital controls — restricting movement of capital out of China, from transfers to foreign investment.

Of course, resourceful Chinese still found ways to move money. Among them, buying Bitcoin. And that’s when Bitcoin started to really move (from sub-$1,000). China cryptocurrency exchanges were said to account for 90% of global bitcoin trading. Capital flows were confused with Silicon Valley genius.

But in September of last year China crackdown on Bitcoin – with a totalban. A few months later, Bitcoin futures launched, which gave hedge funds a liquid way to short the madness. Bitcoin topped the day the futures contract launched.

With the above in mind, I want to copy in my Pro Perspectives note from last December where I discussed the Bitcoin bubble.

|

|

|

|

|

THURSDAY, DECEMBER 7, 2017

With all that’s going on in the world, the biggest news of the day has been Bitcoin.

People love to watch bubbles build. And then the emotion of “fear of missing out” kicks in. And this appears to be one.

Bitcoin traded above $16,000 this morning. In one “market” it traded above $18,000 (which simply means some poor soul was shown a price 11% above the real market and paid it).

As we’ve discussed, there is no way to value Bitcoin. There is no intrinsic value. To this point, it has been bought by people purely on the expectation that someone will pay them more for it, at some point. So it’s speculation on human psychology.

Let’s take a look at what some of the most sophisticated and successful investors of our time think about it…

Billionaire Carl Icahn, the legendary activist investor that has the longest and best track record in the world (yes, better than Warren Buffett): “I don’t understand it… If you read history books about all of these bubbles…this is what this is.”

Billionaire Warren Buffett, the best value investor of all-time: “Stay away from it. It’s a mirage… the idea that it has some huge intrinsic value is a joke. It’s a way of transmitting money.”

Billionaire Jamie Dimon, head of one of the biggest global money center banks in the world: “It’s not a real thing. It’s a fraud.”

Billionaire Ray Dalio, founder of one of the biggest hedge funds in the world: “Bitcoin is a bubble… It’s speculative people, thinking they can sell it at a higher price…and so, it’s a bubble.”

Billionaire investor Leon Cooperman: “I have no money in Bitcoin. There’s euphoria in Bitcoin.”

Billionaire distressed debt and special situations investor, Marc Lasry: “I should have bought Bitcoin when it was $300. I don’t understand it. It might make sense to try to participate in it, but I can’t give you any analysis as to why it makes sense or not. I think it’s real, as it coming into the mainstream.”

Billionaire hedge funder Ken Griffin: “It’s not the future of currency. I wouldn’t call it a fraud either. Bitcoin has many of the elements of the Tulip bulb mania.”

Now, these are all Wall Streeters. And they haven’t participated. But this all started as another disruptive technology venture. So what do billionaire tech investors think about it…

Billionaire Jerry Yang, founder of Yahoo: “Bitcoin as a digital currency is not quite there yet. I personally am a believer that digital currency can play a role in our society, but for now it seems to be driven by the hype of investing and getting a return, as opposed to transactions.

Mark Cuban: He first called it a “bubble.” He now is invested in a cryptocurrency hedge fund but calls it a “Hail Mary.”

Michael Novagratz, former Wall Streeter and hedge fund manager. He once was a billionaire and may be again at this point, thanks to Bitcoin: “The whole market cap of all of the cryptocurrencies is $300 billion. That’s nothing. This is global. I have a sense this can go a lot further. He equates it to an alternative (or replacement) for the value of holding gold – which is an $8 trillion market… over the medium term, this thing is going to go a lot higher.” But he acknowledges it shouldn’t be more than 1% to 3% of an average persons net worth.

Now with all of this in mind, billionaire Thomas Peterffy, one of the richest men in America and founder of the largest electronic broker in the U.S., Interactive Brokers, has warned against creating exchange-traded contracts on Bitcoin. He says a large move in the price could destabilize the clearing organizations (the big futures exchanges), which could destabilize the real economy.

With that, futures launch on Bitcoin on Sunday at the Chicago Mercantile Exchange. This is about to get very interesting.

That was the top.

What stocks do you buy? Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

November 27, 5:00 pm EST

Earlier this month, we talked about the big fall in oil prices.

If we look back over the past five years, the magnitude of that move is only matched (or exceeded) in cases where there was significant manipulation in the oil market and/or a systemically threatening oil price crash.

As we’ve discussed, the pressure on oil this time around seems to be about manipulation — and appears to have everything to do with Trump’s leverage over the Saudis (related to sanctioning the Kingdom over the Khashoggi murder).

But we’ve now traded down to the important $50 mark. That’s 35% from the highs of just October 3. And this is an inflection point where it could go bad, but it also could present a goldilocks scenario (a level that’s just right for the U.S. economy).

Sure, cheap oil is good for consumers. You save a few extra bucks at the pump. But in the current environment, it presents risks to the financial system. The shale industry’s break-even point on producing oil is said to be $50. Below that, they dial down production, lay off workers, stop investing and quickly become a default risk to their creditors (U.S. and global banks). We saw it back in 2016. The same can be said for those countries heavily dependent on oil revenues (i.e. they become default risks as oil prices move lower).

That’s the bad side. The good side to the oil price slide? As we’ve discussed, it should relieve some pressure on the Fed. The Fed likes totalk about their inflation readings excluding effects of volatile oil prices. But they have a record of acting on monetary policy when oil is moving.

The bottom line: Oil plays a big role in their view on inflation. And given the quick drop in oil prices, the Fed’s concerns about inflation should be cooling. Again, this opens up the door for the Fed Chair, tomorrow, to take the opportunity in a prepared speech at the Economic Club of New York, to signal a pause coming in the Fed’s rate normalization program. That would be a positive catalyst for economic and market confidence.

What stocks do you buy? Join me

here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.