|

|

April 17, 5:00 pm EST Last month we talked about Chinese stocks has a key spot to watch for: 1) are they doing enough to stimulate the struggling economy, and 2) (more importantly) are they taking serious steps to get to an agreement on trade with the U.S.? The signal has been good. Chinese stocks are up 34% since January 4th. As I said back in March, Chinese stocks are reflecting optimism that a bottom is in for the trade war and for Chinese economic fragility. That’s a big signal for the global (and U.S.) economy. Fast forward a month, and we’re starting to see it (the bottoming) in the Chinese data. Overnight, we had a better than expected GDP report. And industrial output in China climbed at the hottest rate since 2014. |

|

|

For those that question the integrity of the Chinese GDP data, many will look at industrial output and retail sales. Retail sales had a better than expected number too overnight. And the chart (too) looks like a bottom is in. |

|

|

Remember, by the end of last year, much of the economic data in China was running at or worse than 2009 levels (the depths of the global economic crisis). The signal in stocks turned on the day that the Fed put an end to its rate hiking path AND when the U.S. and China re-opened trade talks (both on January 4th). |

|

April 9, 5:00 pm EST A key piece in the continuation of the global economic recovery will be a weaker dollar. It will drive a more balanced U.S. and global economy, and it will reflect strength in emerging markets (i.e. capital flows to emerging markets). To this point, as we’ve discussed, higher U.S. rates have meant a stronger dollar. With global central banks moving in opposite directions in recent years, capital has flowed to the United States. But the emerging markets have suffered under this dynamic. As money has moved OUT of emerging market economies, their economies have weakened, their currencies have weakened, and their foreign currency denominated debt has increased. But now we have a retrenchment from the Fed. And we have coordinated global monetary policy (facing in the same direction). This sets up to solidify a long-term bear market for the dollar. Let’s take a look at a couple of charts that argue the long-term trend is already lower, and the next leg will be much lower. First, here’s a revisit of the long-term dollar cycles, which we’ve looked at quite a bit in this daily note. Since the failure of the Bretton-Woods system, the dollar has traded in six distinct cycles – spanning 7.6 years on average. Based on the performance and duration of past cycles, the bull cycle is over, and the bear cycle is more than two years in. |

|

|

With this in mind, if we look within this current bear cycle, technically the dollar is trading into a major resistance area – a 61.8% retracement. The next leg should be lower, and for a long period of time. |

|

|

Trump wants a weaker dollar, and I suspect he’s going to get it.

Sign up to my Billionaire’s Portfolio and get my market beating Billionaires Portfolio … Live Portfolio Review conference calls … Weekly notes with updates and specific recommendations on following the best billionaire investors … Access to my member’s only area on the Billionaire’s Portfolio. Plus, my blog — full of information that will set you apart from other average investors. Join now and get your risk free access by signing up here. |

April 8, 5:00 pm EST

As we discussed on Friday, the overhang of risks to markets, to the Trump administration and to the economy are as light as we’ve seen in quite some time.

With this in mind, we have a fairly light data week – which means the likelihood of a disruption in the rise in stocks and risk appetite remains low.

We get some inflation data this week, which should be tame, justifying the central bank dovishness we’ve seen in recent months. The ECB meets this week. They’ve already walked back on the idea that they might hike rates this year. Expect Draghi to hold the line on that. The Chinese negotiations have positive momentum, with reports over the weekend that talks last week advanced the ball. And we have another week before Q1 earnings season kicks in.

So, expect the upward momentum to continue for stocks. Just three months into the year and stocks are up big, and back near record highs in the U.S.. The S&P 500 is up 15% year-to-date. The DJIA is up 13%. Nasdaq is up 20%. German stocks are up 13%. Japanese stocks are up 11%. And Chinese stocks are up 32%.

Remember, we’ve talked about the signal Chinese stocks might be giving us, putting in a low on the day the Fed did it’s about face on the rate path, back on January 4th.

The aggressive bounce we’ve since had in Chinese stocks appears to be telegraphing the bottoming in the Chinese economy. That’s a big relief signal for the global economy. Commodities prices are supporting that view (sending the same signal). Oil is now up 42% on the year. And the CRB industrial metals index is up 24%.

Sign up to my Billionaire’s Portfolio and get my market beating Billionaires Portfolio … Live Portfolio Review conference calls … Weekly notes with updates and specific recommendations on following the best billionaire investors … Access to my member’s only area on the Billionaire’s Portfolio. Plus, my blog — full of information that will set you apart from other average investors.

Join now and get your risk free access by signing up here.

|

|

|

|

|

January 30, 5:00 pm EST Remember, over the past three weeks, the major central banks in the world (the Fed, the ECB and the BOJ) reminded us of the script they have followed, and continue to follow, since the global financial crisis. They will do ‘whatever it takes‘ to keep the economic recovery going. It took an ugly decline in stocks in December to resurrect the defensive stance from the architects of the decade-long global economic recovery. Confidence matters, as it relates to the economic outlook. And stocks heavily influence confidence. With that, the Fed raised the white flag on January 4th when they marched out Bernanke, Yellen and Powell at an economic conference to reset the market expectations on monetary policy (moving from a four rate hike forecast for 2019 to a ‘wait and see’ approach). They solidified that stance today. Removing this risk, of the Fed offsetting the benefits of fiscal stimulus, is continuing to prime global markets. And we get a break of this trendline today in stocks — from the correction that originated from the record highs of October. |

|

|

With the Fed behind us, the attention turns to the U.S./China meetings, which are underway. Let’s revisit the one indicator from China that they are working to pacify the Trump administration. It’s the Chinese currency. Remember, we looked at this chart back on January 11 of the U.S. dollar/Chinese yuan exchange rate … |

|

|

In this chart, the falling orange line represents the Chinesestrengthening their currency. And, as we can see, they have been showing a willingness to make concessions, walking it higher since the December “trade truce.” Make no mistake, the trade war is all about China’s currency. Ultimately, a free floating currency in China would be the solution to the trade imbalances and dangerous wealth transfer of the past few decades. To this point, it has been reported that they are presenting a plan to balance trade with the U.S. in six years. Maybe currency is part of it. We shall see.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

|

|

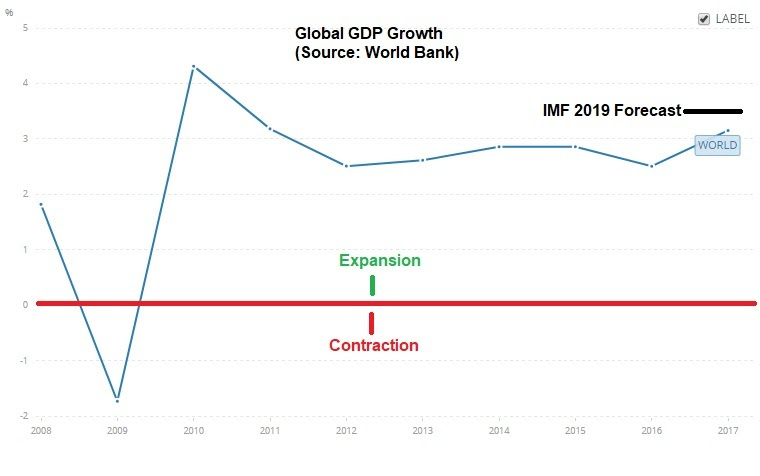

January 23, 5:00 pm EST The financial media has been focused on Davos this week — the host of the World Economic Forum, which is attended by the world’s top global government and corporate leaders. Coming off of an ugly December for global financial markets, it’s no surprise the conversation is all about “slowdown.” It’s an odd conversation, given that the U.S. economy is growing at 3%, corporate earnings are running at record levels, inflation is low and unemployment is low. Even the IMF could only justify a small markdown on their 2019 global GDP forecast — from an already high level. For perspective, the IMF is now looking for 3.5% growth for 2019. Here’s how that looks relative to the past ten years …. |

|

|

So, what’s the story? As we discussed yesterday, it’s China, and the pressure of tariffs and reform demands on a vulnerable large economy that’s already drowning. And the broader view is that trade is being hampered by the Trump/China standoff – and therefore dragging on growth. With that in mind, listening to some interviews from Davos, the one that stuck out to me was the DHL CEO (the world’s leading mail and logistics company). He said trade is not at all on the back foot, rather its flowing more than ever before. So, the global growth slowdown talk is all about what might happen, not about what is happening. It’s about risk. With that, if China does make the concessions necessary to get a deal done (and they seem to have few options), we may end up getting a big upside surprise in global growth – especially given the very accomodative global monetary policy backdrop. Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment. |