May 30, 5:00 pm EST

The first revision of Q1 GDP came in this morning, in-line with expectations (at 3.1%). As yields swoon, and stocks have given back some gains for the month, this growth number today is good reminder that the state of the U.S. economy is good.

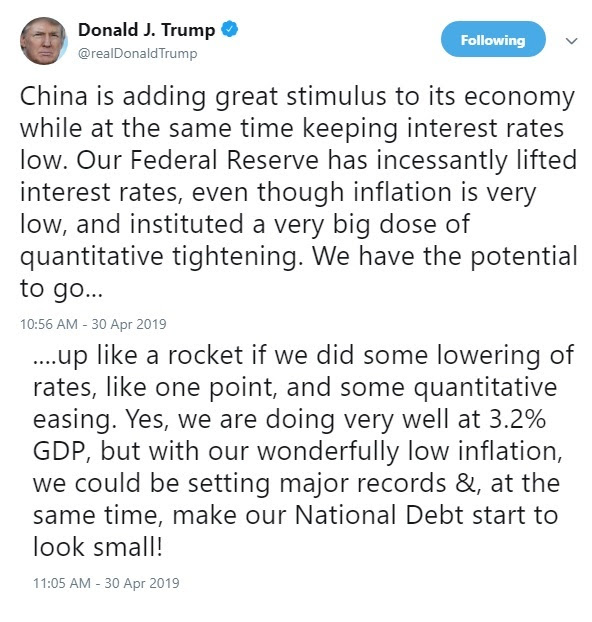

Remember, back in April, the first look at Q1 GDP came in as a huge positive surprise (at 3.2%). Many were expecting it to be a terrible quarter. Goldman Sachs thought the quarter would produce just 0.7% growth. They were wrong, and they weren’t alone. At the end of the first quarter, the Atlanta Fed’s GDP model was estimating that the economy grew at only 0.3% in Q1.

With that in mind, don’t get too caught up in the souring growth story. At the moment, the consensus view on Wall Street is for Q2 growth to come in at 1.8%. And the Atlanta Fed model is looking for 1.3%. Both are well lower than the White House envisioned 3%+ growth trend.

But, for perspective, there are some clear factors working in favor of the higher (not lower) growth case.

The job market is strong. We have monthly new jobs running at a 12-month average of 218k. That’s well above pre-financial crisis average monthly job growth. The unemployment number at 3.6% is the lowest since 1969.

Most importantly: Wage growth has been on the move for the past 18 months, now sustaining above 3%. And Q1 productivity came in at 3.6%, the hottest productivity reading in almost a decade. The economy can grow by expanding the size of the workforce or the productivity of the workforce. We’re finally getting solid productivity growth.

May 9, 5:00 pm EST

Yesterday we talked about the tool China will use to offset tariffs, if a deal does not materialize and the tariff penalty increases.

They will devalue their currency.

With a “no deal” potential outcome, there’s a lot of wealth in China looking for ways out.

In recent years, they have found a way out through Bitcoin. And, no coincidence, Bitcoin is again on the move.

With that, let’s take a look at the timeline on Bitcoin…

The 2016-2017 ascent of Bitcoin coincided perfectly with the crackdown on capital flight in China. In late 2016, with rapid expansion of credit in China, growing non-performing loans, a soft economy and the prospects of a Trump administration that could put pressure on China trade, capital was moving aggressively out of China.

That’s when the government stepped UP capital controls — restricting movement of capital out of China, from transfers to foreign investment.

Of course, resourceful Chinese still found ways to move money. Among them, buying Bitcoin. And that’s when Bitcoin started to really move (from sub-$1,000 to over $19,000). China cryptocurrency exchanges were said to account for 90% of global bitcoin trading.

Chinese capital flows were confused for Silicon Valley genius.

But in late 2017, China cracked down on Bitcoin – with a total ban. A few months later, Bitcoin futures launched, which gave hedge funds a liquid way to short the madness. Bitcoin topped the day the futures contract launched.

So, as Chinese officials visit the White House for a deal or no deal on trade, China has been moving their currency lower — and bitcoin has (again) been moving higher. Perhaps the Chinese are finding new ways to buy Bitcoin.

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here.