|

|

|

|

|

THURSDAY, DECEMBER 7, 2017

With all that’s going on in the world, the biggest news of the day has been Bitcoin.

People love to watch bubbles build. And then the emotion of “fear of missing out” kicks in. And this appears to be one.

Bitcoin traded above $16,000 this morning. In one “market” it traded above $18,000 (which simply means some poor soul was shown a price 11% above the real market and paid it).

As we’ve discussed, there is no way to value Bitcoin. There is no intrinsic value. To this point, it has been bought by people purely on the expectation that someone will pay them more for it, at some point. So it’s speculation on human psychology.

Let’s take a look at what some of the most sophisticated and successful investors of our time think about it…

Billionaire Carl Icahn, the legendary activist investor that has the longest and best track record in the world (yes, better than Warren Buffett): “I don’t understand it… If you read history books about all of these bubbles…this is what this is.”

Billionaire Warren Buffett, the best value investor of all-time: “Stay away from it. It’s a mirage… the idea that it has some huge intrinsic value is a joke. It’s a way of transmitting money.”

Billionaire Jamie Dimon, head of one of the biggest global money center banks in the world: “It’s not a real thing. It’s a fraud.”

Billionaire Ray Dalio, founder of one of the biggest hedge funds in the world: “Bitcoin is a bubble… It’s speculative people, thinking they can sell it at a higher price…and so, it’s a bubble.”

Billionaire investor Leon Cooperman: “I have no money in Bitcoin. There’s euphoria in Bitcoin.”

Billionaire distressed debt and special situations investor, Marc Lasry: “I should have bought Bitcoin when it was $300. I don’t understand it. It might make sense to try to participate in it, but I can’t give you any analysis as to why it makes sense or not. I think it’s real, as it coming into the mainstream.”

Billionaire hedge funder Ken Griffin: “It’s not the future of currency. I wouldn’t call it a fraud either. Bitcoin has many of the elements of the Tulip bulb mania.”

Now, these are all Wall Streeters. And they haven’t participated. But this all started as another disruptive technology venture. So what do billionaire tech investors think about it…

Billionaire Jerry Yang, founder of Yahoo: “Bitcoin as a digital currency is not quite there yet. I personally am a believer that digital currency can play a role in our society, but for now it seems to be driven by the hype of investing and getting a return, as opposed to transactions.

Mark Cuban: He first called it a “bubble.” He now is invested in a cryptocurrency hedge fund but calls it a “Hail Mary.”

Michael Novagratz, former Wall Streeter and hedge fund manager. He once was a billionaire and may be again at this point, thanks to Bitcoin: “The whole market cap of all of the cryptocurrencies is $300 billion. That’s nothing. This is global. I have a sense this can go a lot further. He equates it to an alternative (or replacement) for the value of holding gold – which is an $8 trillion market… over the medium term, this thing is going to go a lot higher.” But he acknowledges it shouldn’t be more than 1% to 3% of an average persons net worth.

Now with all of this in mind, billionaire Thomas Peterffy, one of the richest men in America and founder of the largest electronic broker in the U.S., Interactive Brokers, has warned against creating exchange-traded contracts on Bitcoin. He says a large move in the price could destabilize the clearing organizations (the big futures exchanges), which could destabilize the real economy.

With that, futures launch on Bitcoin on Sunday at the Chicago Mercantile Exchange. This is about to get very interesting.

That was the top.

What stocks do you buy? Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.

January 29, 7:00 pm EST

For the first time in a decade, the mood at the World Economic Forum in Davos was of optimism and opportunity. And Trump economic policies have had a lot to do with it.

That optimism has continued to drive markets higher this year: global stocks, global interest rates, global commodities – practically everything.

The S&P 500 is up nearly 7% on the year now — just a little less than a month into the New Year. And we’ve yet to see the real impact of tax incentives hit earnings and investment.

But, with the rising price of oil (now above $65), and improving consumption (on the better outlook), we will likely start seeing the inflation numbers tick up.

Now, what will be the catalyst to cap this very sharp run higher in stocks to start the year? It will probably be the first “hotter than expected” inflation number.

That would start the speculation that the Fed might need to move rates faster, and it might speed-up the exit talks from QE in Europe and Japan.

If the inflation outlook triggers a correction (which would be healthy), that would set the table for hotter earnings and hotter economic growth (coming down the pike) to ultimately drive the remainder of stock returns for the year.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio subscription service, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio of highest conviction, billionaire-owned stocks is up close to 50% over the past two years. You can join me here and get positioned for a big 2018.

January 22, 7:00 pm EST

We talked last week about the prospects of a government shutdown and the little-to-no impact it would likely have on markets.

Here we are, with a shutdown as we open the week, and stocks are on to new record highs. Oil continues to trade at the highest levels of the past three years. And benchmark global interest rates continue to tick higher.

As we look ahead for the week, fourth quarter earnings will start rolling in this week. But the big events of the week will be the Bank of Japan and European Central Bank meetings. The Bank of Japan (the most important of the two) meets tonight.

Remember, we’ve talked about the disconnect we’ve had in government bond yields, relative to the recovering global economy and strong asset price growth (led by stocks). And despite five Fed rate hikes, bond yields haven’t been tracking the moves made by the Fed either. The U.S. 10-year government bond yield finished virtually unchanged for the year in 2017.

That’s because the monetary policy in Japan has been acting as an anchor to global interest rates. Their policy of pegging their 10-year yield at zero, has created an open ended, unlimited QE program in Japan. That means, as the forces on global interest rates pulls Japanese rates higher, away from zero, they will, and have been buying unlimited amounts of Japanese Government Bonds (JGBs) to force the yield back toward zero. And they do it with freshly printed yen, which continues to prime the global economy with fresh liquidity.

So, as we’ve discussed, when the Bank of Japan finally signals a change to that policy, that’s when rates will finally move–and maybe very quickly.

If they choose, tonight, to signal an end of QE could be coming, even if it’s a year from now, the global interest rate picture will change immediately. With that in mind, here’s a look at the U.S. ten year yields going in …

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio subscription service, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio of highest conviction, billionaire-owned stocks is up close to 50% over the past two years. You can join me here and get positioned for a big 2018.

January 22, 11:00 am EST

With a government shutdown over the weekend, today I want to revisit my note from last month (the last time we were facing a potential government shutdown) on the significance of the government debt load.

The debt load is an easy tool for politicians to use. And it’s never discussed in context. So the absolute number of $19 trillion is a guarantee to conjure up fear in people – fear that foreigners may dump our bonds, fear that we may have runaway inflation, fear that the economy is a house of cards. So that fear is used to gain negotiating leverage by whatever party is in a position of weakness. For the better part of the past decade, it was used by the Republican party to block policies. And now it’s being used by the Democratic party to try to block policies.

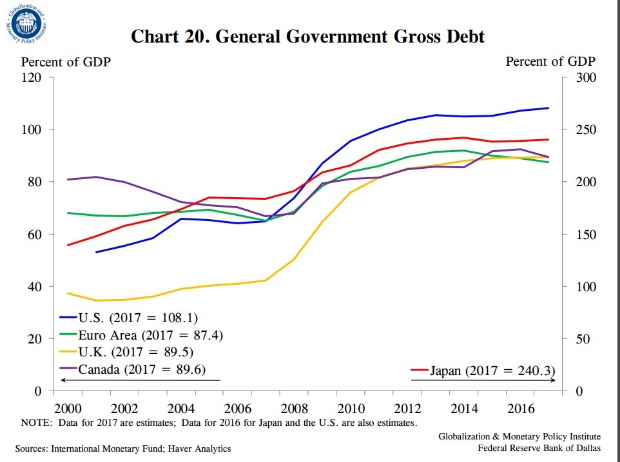

Now, the federal debt is a big number. But so is the size of our economy – both about $19 trillion. And while our debt/GDP has grown over the past decade, the increase in sovereign debt relative to GDP

You can see in the chart below, the increasing debt situation isn’t specific to the U.S.

Now, we could choose to cut spending, suck it up, and pay down the debt. That’s called austerity. The choice of austerity in this environment, where the economy is fragile, and growth has been sluggish for the better part of ten years, would send the U.S. economy back into recession. Just ask Europe. After the depths of the financial crisis, they went the path of tax hikes and spending cuts, and by 2012 found themselves back in recession and a near deflationary spiral – they crushed the weak recovery that the European Central Banks (and global central banks) had spent, backstopped and/or guaranteed trillions of dollars to create.

The problem, in this post-financial crisis environment: if the major economies in the world sunk back into recession (especially the U.S.), it would certainly draw emerging markets (and the global economy, in general) back into recession. And following a long period of unprecedented emergency monetary policies, the global central banks would have limited-to-no ammunition to fight a deflationary spiral this time around.

Now, all of this is precisely why the outlook for the U.S. and global economy changed on election night in 2016. We now have an administration that is focused on growth, and an aligned Congress to overwhelm the political blocking. That means we truly have the opportunity to improve our relative debt-load through growth.

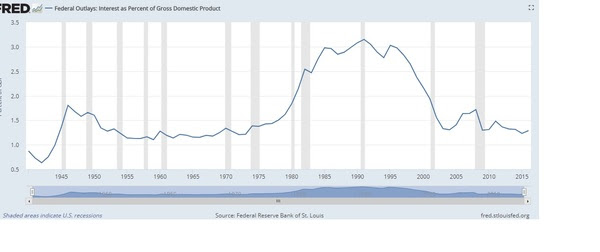

In the meantime, despite all of the talk, our ability to service the debt load is as strong as it’s been in forty years (as you can see in the chart below). And our ability to refinance debt is as strong as it’s been in sixty years.

For help building a high potential portfolio, follow me in our Forbes Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio of highest conviction, billionaire-owned stocks is up close to 50% over the past two years. You can join me here and get positioned for a big 2018.

government shutdown, washington, wall street, economy

January 22, 9:00 am EST

Last week we talked about the big adjustment we should expect to come in the inflation picture. With oil above $60 and looking like much higher prices are coming, and with corporate tax cuts set to fuel the first material growth in wages we’ve seen in a long time (if not three decades), this chart (inflation expectations) should start moving higher…

And with that, market interest rates should finally make a move. As we discussed last week, we will likely have a 10-year yield with a “3” in front of it before long.

Yields have already popped nearly a quarter point since the beginning of the year. But that’s just (finally) reflecting the December Fed rate hike. What hasn’t been reflected in rates, as it has in stocks, is the different growth and wage pressure outlook this year, thanks to the tax cut. Last year, people could argue it wasn’t going to happen. This year, it’s in motion. And the impact is already showing up. We should expect it to show in the inflation data, sooner rather than later.

With that, today we’re knocking on the door of a big breakout in rates (as you can see in the chart below) — which comes in at 2.65%…

As we’ve discussed, the anchor for the benchmark U.S. 10-year yield (and for global rates), even in the face of a more optimistic global economic growth outlook, has been Japan’s unlimited QE (driven by its policy to peg its 10-year at a yield of zero). On that note, last week, the former head of the central bank in India, Raghuram Rajan (a highly respected former central banker), said he thinks both Europe and Japan will exit emergency policies sooner than people think. That’s a positive statement on the global economy and a warning that global rates should finally start moving.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio subscription service, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio of highest conviction, billionaire-owned stocks is up close to 50% over the past two years. You can join me here and get positioned for a big 2018.

January 17, 4:00 pm EST

Yesterday’s slide in stocks was all recovered today, despite the continued threat of a government shutdown. As we discussed yesterday, holding the government budget hostage to make gains on partisan demands hasn’t been enough to move the needle on the stock market the past three times we’ve seen it happen (2013, 1995-1996 and 1990).

Still, incredulously, the chatter about a “top” in stocks was heavy, yesterday afternoon and throughout this morning – given the 300 point move off of the top in the Dow (and accompanied by a sharp slide in bitcoin this morning).

The media and Wall Street experts must need to be reminded daily that we have a huge tax cut hitting this year, into extremely favorable economic conditions (low rates, cheap gas, record low unemployment, record high household net worth, record high consumer credit worthiness), with continued pro-business policies being executed, a major infrastructure spend pursued, and global growth expected to run as hot as we’ve seen since before the financial crisis.

With this in mind, Apple told us today that they plan to repatriate all of their offshore cash (about a quarter of a trillion dollars worth — thanks to a new, massive repatriation tax break), hire 20k people over the next five years and spend $30 billion in capex, to contribute $350 billion to the U.S. economy overall.

So, this is a direct result of incentives. And creating these incentives are the motivations behind the fiscal stimulus policies – all in an effort to achieve the behavior we’re seeing from Apple. Ultimately, it’s all about escaping the dangerously slow economic growth that was manufactured by central banks – so that the 10-year global economic slog doesn’t give way to a full-blown depression. So these incentives are working. Fiscal stimulus is working. And, as we’ve discussed, this should promote the big bounce back in growth that is typical of post-recession recoveries, but has been lacking in this post-financial crisis environment.

Still, people with the most influential voices continue to underestimate the outlook. The Fed is looking for just 2.5% U.S. GDP growth for the year (that’s likely less than what we’ll see for full year 2017). And Wall Street is looking for just 6% growth in stocks (according to this WSJ piece). The S&P 500 is already up 5%.

For help building a high potential portfolio, follow me in our Billionaire’s Portfolio subscription service, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio of highest conviction, billionaire-owned stocks is up close to 50% over the past two years. You can join me here and get positioned for a big 2018.