|

May 31, 5:00 pm EST We end the month of May today. Things were going quite well for markets, with stocks sitting on record highs, until Trump did this over the first weekend of the month …

|

|

|

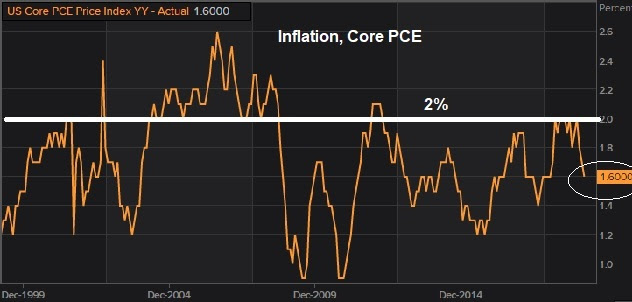

With the above in mind, let’s look back at my May 6th note: “Why would Trump risk complicating a deal, even more, by threatening China with a deadline/tariff increase? Because he has leverage. He has a stock market near record highs, and a strong economy and the winds of ultra-easy global monetary policy at his back … So, Trump has a win–win going into the week. If the threat works, he gets a deal done, and likely gives less to get it done. If China backs off, stocks go down, and he gets the Fed’s rate cut he’s been looking for–stocks go back up.” As we know, China walked. And Trump is now using a similar position of strength to influence policy with Mexico. As such, stocks have now fallen nearly 7% from the highs. And the prospects for a Fed rate cut are looking very strong. How strong? The interest rate market is pricing in a 90% chance of a rate cut by year end, and a 60% chance of a two rate cuts. But despite the sharp decline in global interest rates, the market seems to be well underestimating the chances for a Fed rate cut this month — at the June 19 Fed meeting. There are two clear influences on Fed policy over the past few years. Stocks and crude oil. The latter weighs on inflation. While the Fed claims to ignore the influence of food and energy in their inflation measure, they have a history of acting when oil moves sharply. And inflation is already running at very soft levels. On that note, what was the biggest loser for the day, week and month? Crude oil. Crude was down 7.5% today, 10% for the week, and 16% for the month. If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential. Join now and get your risk free access by signing up here. |