|

October 31, 5:00 pm EST

As we discussed yesterday, it’s very dangerous to let political views influence your perspective on markets and investing.

And I suspect we are seeing plenty of people make that mistake.

That means many will be left behind on a stock market recovery, again. That probably means the bull market for stocks still has a ways to run. John Templeton, know to be one of the great value and contrarian investors of all time, said “bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

Incredibly, after a more than four-fold run from the financial crisis bottom, the stock market continues to have a LOT of skepticism. Does this mean we are only half way through this cycle? Maybe.

The arguments for the stock market bears and pessimists on the economy have many holes, but the biggest is the lack of context. That context: the global economic crisis, and the aftermath (up to present day).

You can’t evaluate anything about this economy without taking into account where we’ve been over the past decade, the role central banks have played throughout, the coordinated intervention that has taken place globally (along the way) to avoid a global depression, and the interconnectedness of global economies that continues.

Without this context, the skeptics like to call it “late in the cycle” for an economy that (on paper) is in the second-longest expansion in U.S. history. With context, we’re probably closer to “early cycle,” given that the decade of ultra-slow growth was manufactured by central banks.

|

|

October 25, 5:00 pm EST Yesterday we looked at this big trendline support in stocks (the yellow line).

|

|

|

We had a good bounce today, but experience tells me that we will make a run at that trendline, and things will look a little messy before we bottom. We still have seven trading days before the mid-term elections. A stock market in correction is not as easy to promote as one at record highs (as we had just earlier this month). With that, I suspect there are plenty of interests (China among them) to keep the pressure on stocks in hopes of dividing U.S. Congress come November 6th. When the dust clears from the elections, market folks will realize that stocks are incredibly cheap at 15 times next year’s earnings estimates, in an economy growing better than 3%. On that note, we have our first look at third quarter GDP tomorrow. The market is looking for 3.6% growth, which would give us 3.22% annualized growth averaged over the past four quarters. That would be the best growth since 2006. If you need help with your shopping list of stocks to buy on this dip, join me in my Billionaire’s Portfolio. We follow the world’s bests billionaire investors into their favorite stocks. Click here to learn more. |

|

October 8, 5:00 pm EST China was on holiday last week (Golden Week). So today, with China back to work, we saw the response in Chinese markets, for the first time, to the spike in global bond yields (and the slide in global stocks). Chinese stocks fell by 3.7%. The yuan slid back to the 21-month lows. And the PBOC stepped in with the fourth cut of the year to its reserve ratio. Now, China has been running sub-7% growth since late 2015. And in China, that’s recession like economic activity. The Chinese government’s sensitivity to this level of growth is clear through the behavior of the central bank’s use of RRR cuts and the currency (the yuan). Cutting the required reserves for banks is a way to stimulate the economy – to promote lending. Weakening the currency is a way to stimulate exports. You can see in the chart below, that has been the path for both (the currency and the RRR) since late 2015. |

|

| You can also see in the chart, a period where the yuan strengthened sharply. What gives?

That was China’s response to the Trump election. The Chinese ran the currency back UP, in hopes of pacifying Trump and staying above the trade dispute fray. It didn’t work. As we know, they have found themselves at the center of Trump’s trade offensive. As such, they have dug in, and returned to weakening the yuan — the best way they know, to defend/drive growth in their economy (i.e. undercut the world on price). The USD/CNY rate here will probably become the most important market to watch in the coming days and weeks. A return to 7 yuan per dollar would be the weakest level of the Chinese currency since 2008, pre-Lehman. That will cause some geopolitical fireworks. Attention loyal readers: The Billionaire’s Portfolio is my premium advisory service. And I’d like to invite you to join today, as we are beginning what I think will be a tremendous run for value stocks into the end of the year. It’s a great deal for the money. Just click here to subscribe, and get immediate access to my full portfolio of billionaire-owned stocks. When you join, you’ll get immediate access to every recommendation–past, present and future–in the portfolio. And I’ll deliver my in-depth notes on our portfolio and the bigger picture every week, directly to your inbox.

|

|

October 5, 5:00 pm EST We ended the week with the jobs report today. The headline payroll number itself is less important. It’s been plenty good for the past seven years, and has averaged over 200,000 new jobs over the past twelve months. Remember, the missing piece in this report, that has NOT confirmed a hot job market, has been wage growth. Throughout much of the post-Great Recession environment, despite the low headline unemployment number that central banks were able to manufacture, workers had little leverage in the job market to maximize potential, much less command higher wages. That means mid-level managers were happy to have a job and keep it, and college graduates were (have been) relegated to a career as a barista. That’s not a sign of a hot economy. That said, wage growth has been on the move, but slowly. Today’s report of the September average weekly hourly wages was up 2.8% (compared to last year this time). Here’s what the history of that number looks like:

|

|

|

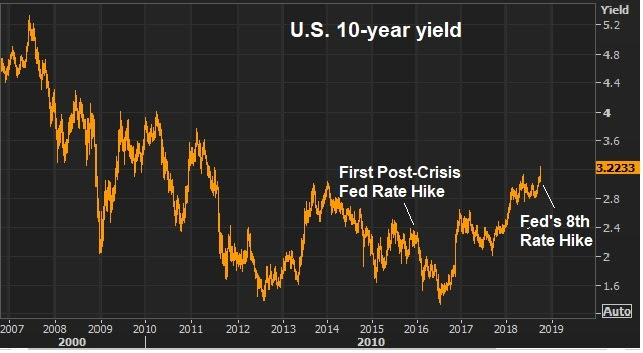

So wages are on the rise, but not fast. And that explains why inflation is on the rise, but not fast. That should comfort those who think the interest rate market is about to run away. Remember, the Fed hiked by another 25 basis points last month, and contrary to what we’ve seen throughout the Fed’s three-year tightening cycle, the bond markets are finally beginning to price some of it in. |

|

|

For perspective, the Fed went by another 25 basis points in September, and the 10-year yield has since risen by 20 basis points.

As you can see in the chart, we’ve had 200 basis points of Fed tightening since December of 2015. But the 10-year yield, since the Fed began “normalizing” policy three years ago, has risen less than half of that (<100 basis). It’s far from a runaway train in the market-determined interest rate market. As I said yesterday, the move in rates is a growth story, not a crisis (or end of growth) story. With the optimism of economic momentum supported by fiscal stimulus and structural reform, the interest rate market is finally pricing OUT the risks of slow growth forever and post-Great Recession crises. |

October 4, 5:00 pm EST

For perspective, the Fed has now moved 8 times off of zero. The leaves the benchmark (short term) rate set by the Fed at 2-2.25%, still well below long-term average rates. And that leaves the market determined (longer term) interest rate, just below 3.25%, still well below the long-term average. With that, rates are still low. In fact, if we took the record low in the 10-year yield, set in July of 2016, and applied the Fed’s 200 basis points of hikes, we would have a 10-year of 3.34%. We are still south of that. I would argue at current levels, the interest rate market is finally pricing in sustainable economic recovery (pricing out risks of another post-economic crisis shock/slump).

Now, when rates are on the move, people immediately start talking about debt service. On that note, consumers and companies are in as good a financial position as they’ve been in a very long time (record high household net worth, record profits) . Household debt service ratios are at record lows.

Bottom line, the move in rates is a growth story, not a crisis story. We have 3%+ economic growth, with low inflation and solid employment. We may have finally returned to the level of trust and confidence in the economy that fuels “animal spirits.”

Attention loyal readers: The Billionaire’s Portfolio is my premium advisory service. And I’d like to invite you to join today, as we are beginning what I think will be a tremendous run for value stocks into the end of the year. It’s a great deal for the money. Just click here to subscribe, and get immediate access to my full portfolio of billionaire-owned stocks. When you join, you’ll get immediate access to every recommendation–past, present and future–in the portfolio. And I’ll deliver my in-depth notes on our portfolio and the bigger picture every week, directly to your inbox.

|

October 3, 5:00 pm EST China remains the hold-out on making a deal with Trump on trade. And itlooks likely that they are holding out to see what the November elections look like. Will Trump retain a Republican led Congress? I suspect we may see China do what they can to influence that outcome. As we know, the Republicans will be promoting the economy as we get closer to voting day. What can China do to rock that boat? They can sell Treasuries, in an attempt to ignite a sharper climb in rates. And a fast move in rates (at these levels) has a way of shaking confidence in equity markets – which has a way of shaking confidence in the economy. As we’ve discussed, the economy can withstand a 10-year yield in the low 3s. But what has spooked market this year (namely stocks) is the fear that a 3% 10-year could quickly turn into a 4% 10-year. We may have seen a taste of it today. We had a run from 3.08% to 3.18%. That’s the highest level since 2011. And stocks came off of the highs. If China was the culprit, or if China chooses to dump some Treasuries over the next month, in attempt to stir up some instability in markets, we should see them move that money elsewhere. The likely recipient of that capital would be gold. It wasn’t evident with the behavior gold today. Gold had a big dayyesterday, but backed off today, even as rates ran. But as you can see in the chart below, the set up for a bounce in gold here looks ripe. The level to watch will be 1214. |

|

|

Attention loyal readers: The Billionaire’s Portfolio is my premium advisory service. And I’d like to invite you to join today, as we are beginning what I think will be a tremendous run for value stocks into the end of the year. It’s a great deal for the money. Just click here to subscribe, and get immediate access to my full portfolio of billionaire-owned stocks. When you join, you’ll get immediate access to every recommendation–past, present and future–in the portfolio. And I’ll deliver my in-depth notes on our portfolio and the bigger picture every week, directly to your inbox.

|

|

October 2, 5:00 pm EST Italy’s face-off with the EU is ramping up, following their announcement last week of plans to increase their deficit spending. Why does it matter? This is another round of populist push-back against policies that have stifled economic recovery and threatened sovereignty over the past decade. We’ve seen it play out in Greece, in the UK, and in the U.S. 2016 election. |

|

|

With risk rising of a shakeout in Europe, you can see in the chart above, money is moving out of Italian government bonds and into German government bonds. This sends Italian yields UP and German yields DOWN — on what is already a 300 basis points spread between the two 10 year borrowing rates. A continuation of this puts pressure on Italian solvency. But this will all likely end favorably for Italy and for the broader European economy. Because as Italy pushes back on austerity, we’ll likely to see the EU make concessions on fiscal constraints, that will open the door for fiscal stimulus across Europe. The policymakers know very well that the health of the “monetary union” is the lynchpin in Europe. If it’s pulled (by an exit of a constituent member), the European Union will crash and fracture. That’s why the ECB stepped in back in 2012 to prevent debt defaults in Italy and Spain. And that’s why EU officials have made concessions throughout, on aid to keep Greece alive. Italy’s resistance will come with a lot of draconian threats and warnings (from EU officials, as we’ve already seen), but in the end Italy may be the catalyst to unlock growth in Europe. Trump has laid out the playbook for economic stagnation. It’s aggressive fiscal stimulus. Europe should follow that lead. Attention loyal readers: The Billionaire’s Portfolio is my premium advisory service. And I’d like to invite you to join today, as we are beginning what I think will be a tremendous run for value stocks into the end of the year. It’s a great deal for the money. Just click here to subscribe, and get immediate access to my full portfolio of billionaire-owned stocks. When you join, you’ll get immediate access to every recommendation–past, present and future–in the portfolio. And I’ll deliver my in-depth notes on our portfolio and the bigger picture every week, directly to your inbox. |

October 1, 5:00 pm EST

Given the global nature of business within the Dow constituents, the DJIA has been the place for pain, as uncertainty over trade has ebbed and flowed over the past year. So, with a new trade agreement with Mexico and Canada, we get a big rally in the Dow today. That puts the Dow up 7.8% on the year.

Still, we came into the year expecting something much bigger for stocks.

The big tax cuts that came near the end of last year, have indeed translated into big corporate earnings surprises, and a hotter than expected economy. This is something you would expect to be fuel for a much bigger than average year for broader stock markets. And you would expect it to be fuel for a big run in commodities markets. But the stock market performance is sitting right around long-term average gains. And broad commodities performance (if we look at the CRB index) is up just 2% on the year.

This has all been supressed by the uncertainties surrounding trade, and the resulting rising geopolitical tensions.

But with concessions from Europe on trade earlier in the summer, and now a new agreement on North American trade, Trump is clearly winning on trade.

What’s next? Infrastructure. This has been the next pillar of Trumponomics. Gary Cohn, the former White House economic advisor, said he thinks the White House will get it done ($1 trillion+) regardless of who controls the House after November.

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.