November 6, 5:00 pm EST

In my note yesterday, we talked about the probable outcomes for the elections.

Whether we see the Republican’s retain control of the house, or lose it, both scenarios should be a greenlight for stocks.

Why? Because the cloud of uncertainty will be lifted. Even if we were to have gridlock in Washington, from here forward, the economy has strong momentum already, and the benefits of fiscal stimulus and deregulation are still working through the system.

Now, given today’s midterm elections are feeling a bit like the Presidential election of 2016 (as a referendum on Trump, this time), I want to revisit my note from election day on November 8, 2016.

As I said at that time, central banks had been responsible for the global economic recovery of the prior nine years, and for creating and maintaining relative economic stability. And creating the incentives to push money into the stock market (i.e. push stocks higher) played a big role in the coordinated strategies of the world’s biggest central banks. With that, I said “neither the economic recovery, nor the stock market recovery can be credited much to politicians. In this environment, in the long run, the value of the new President for stocks will prove out only if there’s structural change. And structural change can only come when the economy is strong enough to withstand the pain. And getting the economy to that point will likely only come from some big and successfully executed fiscal stimulus.”

It turns out, Trump has indeed executed on fiscal stimulus. And he’s gone aggressively after structural change too (perhaps too early, and with some success, but at a price he may pay for politically). Still, he’s been able to execute ONLY because he’s had an aligned Congress.

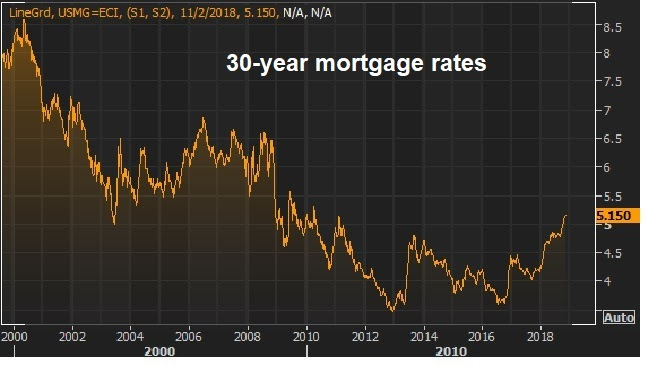

Importantly, the economic policies out of Washington have allowed the Fed to bow-out of the game of providing life support to an economy that was nearly killed by the financial crisis. That’s good!

October 31, 5:00 pm EST

As we discussed yesterday, it’s very dangerous to let political views influence your perspective on markets and investing.

And I suspect we are seeing plenty of people make that mistake.

That means many will be left behind on a stock market recovery, again. That probably means the bull market for stocks still has a ways to run. John Templeton, know to be one of the great value and contrarian investors of all time, said “bull markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.”

Incredibly, after a more than four-fold run from the financial crisis bottom, the stock market continues to have a LOT of skepticism. Does this mean we are only half way through this cycle? Maybe.

The arguments for the stock market bears and pessimists on the economy have many holes, but the biggest is the lack of context. That context: the global economic crisis, and the aftermath (up to present day).

You can’t evaluate anything about this economy without taking into account where we’ve been over the past decade, the role central banks have played throughout, the coordinated intervention that has taken place globally (along the way) to avoid a global depression, and the interconnectedness of global economies that continues.

Without this context, the skeptics like to call it “late in the cycle” for an economy that (on paper) is in the second-longest expansion in U.S. history. With context, we’re probably closer to “early cycle,” given that the decade of ultra-slow growth was manufactured by central banks.

October 30, 5:00 pm EST

This violent repricing of the tech giants came with clear warnings (i.e. the tightening of regulatory screws).

Now that we have it. And it is very healthy, and needed.

As we discussed yesterday, I would argue we are seeing regulation priced-in on the tech giants, which can create a more level playing field for businesses, more broad-based economic activity, and a more broad-based bull market for stocks. This is a theme we’ve been discussing in my daily note here for quite sometime.

And I suspect now, we can see the areas of the stock market that have been beaten down, from the loss of market share to the tech giants, make aggressive comebacks.

On that note, here’s another look at the big trendline we’ve been watching in the Dow …

Again, this line holds right at the 10% correction mark. And we’ve now bounced more than 700 dow points.

As I’ve said, it’s easy to get sucked into the daily narratives in the financial media, and it’s especially easy and dangerous (to your net worth) when stocks are declining. They tend to influence people to sell, when they should be buying.

And as someone that has been involved in markets more than 20 years, I can tell you that it’s also very dangerous to let political views influence your perspective on markets and investing. And I suspect we are seeing that mistake made in this environment (by pros and amateurs alike).

If you need help with your shopping list of stocks to buy on this dip, join me in my Billionaire’s Portfolio. We follow the world’s bests billionaire investors into their favorite stocks. Click here to learn more.

October 12, 5:00 pm EST

The S&P 500 has declined more than 5% (from peak to trough) on four different occasions this year. That’s despite an economy that is heating up, finally escaping the slow growth rut of the past decade.

So, should you be fearful when these declines occur, or should you be greedy?

During market declines – with the constant barrage of market analysis and opinion on financial television, in newspapers, or through the Internet – it’s easy to get sucked into drama played out in the media.

And that tends to make many investors fearful.

But while the fearful start running out of the store when stocks go on sale, the best billionaire investors in the world, start running IN.

The fact is, the best investors in the world see declines in the U.S. stock market as an exciting opportunity. And so should you.

Most average investors in stocks are NOT leveraged. And with that, they should have no concern about U.S. stock market declines, other than saying to themselves, “what a gift,” and asking themselves these questions: “Do I have cash I can put to work at these cheaper prices? And, where should I put that cash to work?”

Billionaire Ray Dalio, the founder of the biggest hedge fund in the world, has said what we think is the most simple yet important fact ever said about investing.

“There are few sure things in investing … that betas rise over time relative to cash is one of them.”

In plain English, he’s saying that major asset classes, over time, will rise (stocks, bonds, real estate). The value of these core assets will grow faster than the value of cash.

That comes with one simple assumption. The world, over time, will improve, will grow and will be a better and more efficient place to live than it was before. If that assumption turned out to be wrong, we have a lot more to worry about than the value of our stock portfolio.

With that said, as an average investor that is not leveraged, dips in stocks (particularly U.S. stocks – the largest economy in the world, with the deepest financial markets) should be bought, because in the simplest terms, over time, the broad stock market has an upward sloping trajectory.

This is the very simple philosophy Dalio follows, and is the core of how he makes money and how he has become one of the best, and richest, investors alive.

Billionaires Bill Ackman and Carl Icahn, two of the great activist investors, lick their chops when broad markets sell off on fear and uncertainty.

Ackman says he gets to buy stakes in high quality businesses at a discount when broad markets decline for non-fundamental reasons. Icahn says he hopes a stock he owns goes lower so he can buy more.

What about the great Warren Buffett? What does he think about market declines? He has famously attributed his long-term investing success to “being greedy when others are fearful.”

Bottom line: Declines in the broad market are times to take out your shopping list.

If you need help with your shopping list, join me in my Billionaire’s Portfolio. We follow the world’s bests billionaire investors into their favorite stocks. Click here to learn more.