There’s a lot of excitement about the building IPO docket for the year. Let’s take a look of the lay of the land …

There is said to be more than 220 companies planning to go public in 2019.

On Friday, Lyft filed an S1 with the SEC (a prospectus like document) in preparation for an IPO. This will be the first Silicon Valley darling to go public this year.

Lyft is the second largest ride-sharing company — owns about a third of the U.S. market, with Uber owning the rest. Uber is expected to go public this year. The other big ones coming: Airbnb, WeWork and Palantir.

We’ve clearly had a boom cycle in Silicon Valley over the past decade. But are these IPOs coming late the party?

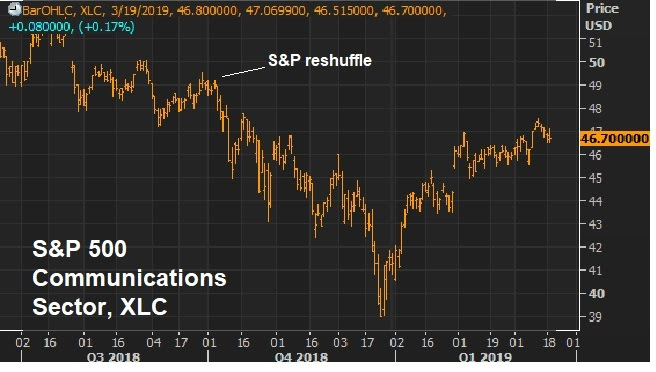

Remember, we have an administration in Washington that has tightened the regulatory screws on the dominant publicly-traded tech giants (Facebook, Amazon, Google). The regulatory tailwinds (or lack thereof) that they enjoyed along the path of their disruptive growth, have now turned into headwinds. And the stocks have all been hit, as a result.

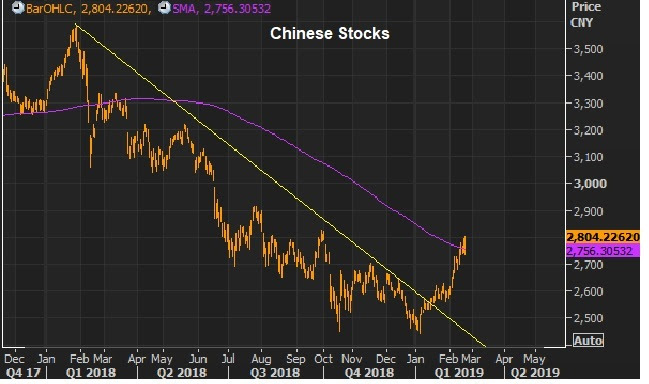

Keep in mind, the private market valuations were pumped-up in these IPO candidates when public equity markets were offering little optimism about future returns. With that, pension money was flowing into the coffers of Silicon Valley private equity firms. And private equity fund managers were throwing money at things — and companies have been burning through that money, ramping staff, buying fancy offices and inundating us with blitz advertising campaigns.

Safe to say there has been an overhyping of the term “disrupters.” In many cases, we’re looking at startups trying to underprice and outspend (with our pension money) in a traditional business, without having the hurdle of making money (maybe ever). Not surprisingly, there have been market share wins.

But public companies tend to be held to a standard: profitability. We’ll see how they do with the shifting market environment (i.e. late cycle Silicon Valley).

Lyft will be an early indicator. Its last private investment valued the company at $15.1 billion. For that, in their filing, they revealed a company doing a little over $2 billion in revenue, while losing almost a billion dollars last year. Revenue growth has been slowing, losses have been widening as the private equity investors attempt to cash out in the public markets.

Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment.