July 5, 5:00 pm EST

I hope everyone had a great Fourth of July yesterday. Today, the markets continue to be thinly traded as we head into the jobs report tomorrow.

We did get minutes from the recent Fed meeting today. This is a closer look into the views of the Fed from their June meeting. Of course, we already had a lot of information from that June meeting: the Fed hiked rates for the second time this year, they telegraphed an additional hike for the year in their projections, plus the June meeting was also accompanied by a press conference from Fed chair Jay Powell. And his explicit “main takeaway” was … “the economy is doing very well.”

With this in mind, as we head into tomorrow’s jobs numbers, the 10-year yield is probably the most important chart to watch. While inflation isn’t near reflecting an economy that’s running hot, the interest rate market is even more disconnected.

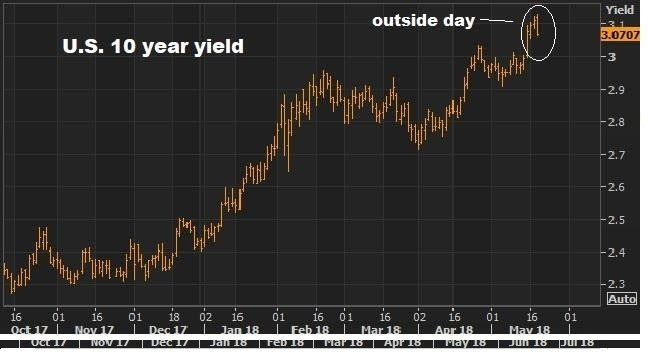

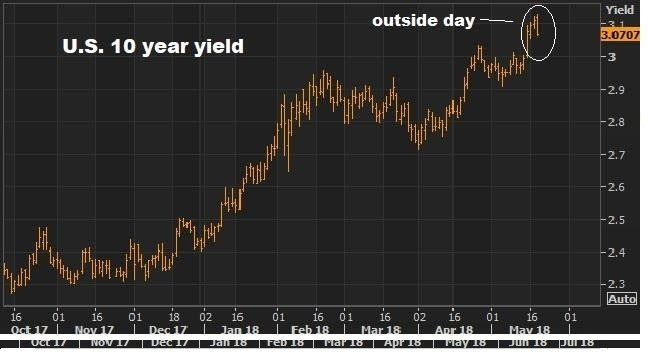

Remember, back on May 18, in my Pro Perspectives note, we discussed this chart …

|

|

As the world was becoming concerned with the speed and level of market interest rates, we had this big technical reversal signal hit for the key 10-year government bond yield.

We focused on this in my May 18th piece, where I said “this technical phenomenon, when closing near the lows, is a very good predictor of tops and bottoms in markets, especially with long sustained trends.” And I said, “I suspect we may have seen some global central bank buyers of our Treasuries today (which puts downward pressure on yields) to take a bite out of the momentum.”

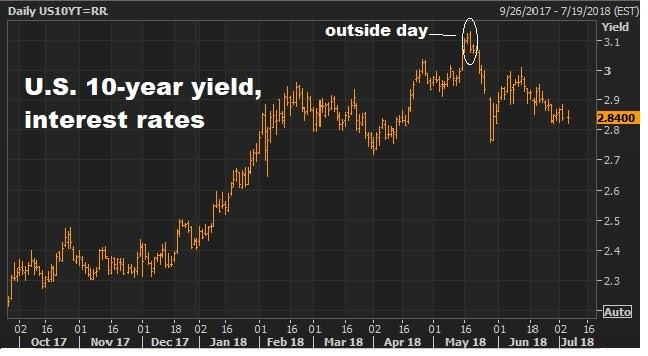

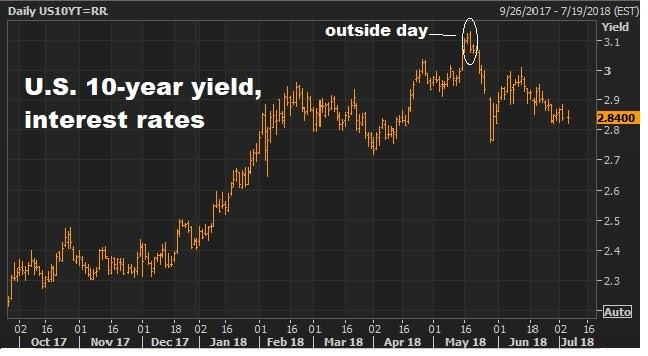

Today the chart looks like this …

|

|

So, that outside day did indeed predict a reversal. And we head into tomorrow’s job report with the benchmark 10-year yield at just 2.84%. That’s in a world where the economy is running at 3% growth and unemployment is under 4%.

But this disconnect may be changing tomorrow. The key data point tomorrow will be wages (Average Earning), not jobs. A hot number there will likely turn this around, and bring higher rates back into the picture.

If you haven’t joined the Billionaire’s Portfolio, where you can look over my shoulder and follow my hand selected 20-stock portfolio of the best billionaire owned and influenced stocks, you can join me here.

|

November 21, 2016, 6:30pm EST

Stocks hit new record highs again in the U.S. today. This continues the tear from the lows of election night. But if we ignore the wild swing of that night, in an illiquid market, stocks are only up a whopping 1.2% from the highs of last month — and just 8% for the year. That’s in line with the long term average annual return for the S&P 500.

And while yields have ripped higher since November 8th, we still have a 10 year yield of just 2.32%. Mortgages are under 4%. Car loans are still practically free money. That’s off of “world ending” type of levels, but very far from levels of an economy and markets that are running away (i.e. you haven’t missed the boat – far from it).

Despite this, we’re starting to see experts come out of the wood works telling us that the economy has been in great shape for a while. That’s what this is about – what’s with all the fuss? Not true.

Remember, it was just eight months ago that the world was edging toward the cliff again, as the oil price bust was threatening to unleash another global financial crisis. And that risk wasn’t emerging because the economy was in great shape. It was because the economy was incredibly fragile — fueled by the central banks ability to produce stability, which produced confidence, which produced some spending, hiring and investment, which produced meager growth. But given that global economic stability was completely predicated on central banks defending against shocks to the system, not on demand, that environment of stability was highly vulnerable.

Now, of course, we finally have policies and initiatives coming down the pike that will promote demand (not just stability). If have perspective on where markets stand, instead of how far they’ve come from the trough of election night, we’re sitting at levels that scream of opportunity as we head into a new pro-growth government.

When the economic crisis was in the early stages of unraveling, the most thorough study on past debt crises (by Reinhart and Rogoff) found that delevering periods (the time after the bust) took about as long as the leveraging period (the bubble building period before the bust). With that, it was thought that the deleveraging period would take about 10 years. History gave us the playbook, in hand, from very early on in the crisis.

With that in mind, the peak in the housing market was June of 2006. That would put 10 years at this past June. The first real event, in the unraveling of it all, was the bust of two hedge funds at Bear Stearns in mid 2007. That would put the 10 year mark at seven months out or so.

That argues that we’re not in the late stages of an economic growth cycle that was just unfortunately weak (as some say), but that we should just be entering a new growth phase and turning the final page on the debt crisis. And that would argue that asset prices are not just very cheap now, but will be for quite some time as a decade long (or two) prosperity gap closes.

Follow me in our Billionaire’s Portfolio, where you look over my shoulder as I follow the world’s best investors into their best stocks. Our portfolio is up 20% this year. That’s almost 3 times the performance of the broader stock market. Join me here.

Oil has surged to open the week. If you’ve been reading our daily pieces over the past few weeks, you’ll know how important oil is for global markets at this stage. With that, strong oil today has translated into higher stocks, higher broad commodities, a slight bump higher in interest rates and better investor sentiment in general.

It was just fourteen days ago that Chesapeake Energy, one of the largest producers of oil and natural gas was rumored to be choosing the path of bankruptcy. That rumor was immediately denied by the company. And soon thereafter, the reality set in for markets that a scenario like that would conjure up post-Lehman like outcomes. Oil has since put in a bottom and bounced more than 25%. Chesapeake has now bounced 46% from the lows just the last six trading days.

It’s at extremes in markets where the biggest and best investors have historically made their money – running into risk, when everyone else is running away.

To follow the stock picks of the world’s best billionaire investors, subscribe at Billionaire’s Portfolio.

With that, today we want to take a look at a few stocks with the biggest upside, and an important “risk buffer” in what is a high risk sector at the moment (energy). This risk buffer? Each stock has the presence of a big-time billionaire investor.

Self-made billionaire energy trader Boone Pickens has said he expects oil to return to $70 this year. On his $70 prediction, he’s also said that if he misses it will be because oil is “over $70, not under $70.” If Pickens is right about oil prices, each of these stocks below have huge upside:

1) Oasis Petroleum (OAS) – Billionaire hedge fund manager John Paulson owns nearly 4% of this stock. The activist hedge fund SPO Advisory owns 14% and has been buying the stock on almost every dip. When oil was last $70, OAS was trading $25 or 500% higher than current levels.

2) Chesapeake Energy (CHK) – Billionaire investor Carl Icahn owns 11% of CHK and recently added to his position around $13. The last time oil was $70, Chesapeake was $25. That would be more than a 1000% return from its price today.

3) EXCO Resources (XCO) – Billionaire investors Wilbur Ross and Howard Marks own more than 30% of this energy stock. The last time oil was $70, EXCO was $3.30. That would be almost a 330% return from its price today.

4) Consol Energy (CNX) – Billionaire David Einhorn owns 12.9% of this stock. When oil was last $70, Consol traded for $40 or almost 500% higher than current levels.

5) Williams Companies (WMB) – Carl Icahn Protégé, Keith Meister of the activist hedge fund Corvex Management, owns $1.1 billion worth of WMB. The last time oil was $70, WMB traded for $50 – more than 300% higher than its current levels.

As we’ve said, persistently cheap oil (at these prices) has become the new “too big to fail” — it’s a systemic risk. It’s hard to imagine central banks will sit back and watch an OPEC-rigged price war put the global economy back into an ugly downward spiral. And time is the worst enemy to those vulnerable first dominoes (the energy industry and weak oil producing countries).

The best investors like to go where the biggest risks are — that’s where the biggest returns can follow. And they’ve been getting aggressive in energy and commodities.

Without question, energy stocks have been beaten up and left for dead. If indeed Chesapeake is a leading indicator that it’s all backing away from the edge, there will be big money to be made in these stocks.

We already have one of the best performing stocks in the entire stock market for the month of February in our Billionaire’s Portfolio, billionaire-owned Freeport McMoran. Click here and join us!

Last week the Wall Street Journal published a report on 70 activist campaigns, looking back over the past six years. No surprise, in evaluating these campaigns, they found that activism works.

With the ability to buy controlling stakes in public companies, we know that activist investors can influence outcomes in the stocks they buy. They have the unique privilege of controlling their own destiny. With that edge, these investors have proven to produce a significant return over what the broader market gives you over time, on average.

When we follow these activist investors into stocks, piggybacking their moves, not only do we get to participate in their performance, for free, but we get an investor on our side that has a lot of money on the line (both their investor’s money and often a lot of their personal money). With that, we get to follow the lead of someone with power and influence, and with every incentive to see the campaign succeed.

Given their record of success, when an activist investor takes a position in a stock and publicly gives a price target for the stock, we take note.

In each of the five stocks listed below, a billionaire investor or hedge fund is calling for a double:

1) Macy’s (NYSE:M) – Starboard Value, a top $4 billion activist hedge fund, said at the Ira Sohn Hedge Fund Conference that Macy’s could be worth $125 a share if the company would sell or spin off its real estate. The stock today sells for $50.36. If Starboard is right, the stock has a 172% potential return.

2) NCR (NYSE:NCR) – Marcato Capital, a $3 billion activist hedge fund run by Bill Ackman’s protégé, Mick McGuire, said that NCR could be worth as much as $51 to $59 a share. The stock is $25 today. If McGuire is right, NCR has a double in it (or more).

3) Bob Evans (NASDAQ:BOBE) – Sandell Asset Management, a top billion dollar plus activist hedge fund, said that Bob Evans could be worth as much as $90 a share if it sold or spun off its real estate. Bob Evans sells for $44 a share. A move to $90 would be a 105% return.

4) Yum Brands (NYSE:YUM) – Carl Icahn protégé, Keith Meister, who runs the $8 billion activist hedge fund Corvex Management, said at Ira Sohn this year that YUM could be worth as much as $130 a share, if the company spun off its Chinese operations. With the stock selling at $70 that is an 86% potential return.

5) Brookdale Senior Living (NYSE:BKD) – Billionaire Larry Robbins of the $15 billion hedge fund Glenview Capital Management has said that Brookdale could double, as the company’s real estate was worth as much as its share price. That is when the stock was trading at $30. Today Brookdale sells for $22.87 which would imply a 161% potential return.

Sign up for our Free ebook, The Little Black Book of Billionaire Secrets, and learn how to follow the “best ideas” of the world’s top billionaire investors. You don’t have to be rich to take part. You don’t have to pay the hefty 2% management fee and 20% profit share to a hedge fund. You can follow the lead of powerful billionaire investors by simply buying the same stocks they do, in your own brokerage account.

How BillionairesPortfolio.com Predicted the Big Pop In Sarepta Therapeutics

The Carl Icahn Effect & How It Can Work For You

Related: stock market, stocks, finance, investing, billionaire, hedge funds, billionaires, dow jones, wall street