May 3, 5:00 pm EST

If you are a regular reader of my daily notes, you’ll know we’ve been discussing the setup for positive surprises all year.

As we’re near the end of Q1 earnings season, clearly we’re getting it. With 78% of the companies in the S&P 500 now reported on Q1 earnings, 76% have beat earnings estimates.

And we’re getting positive surprises in the economic data. We had a huge positive surprise for Q1 GDP this week. And today we had a blow out jobs report.

There were 263k jobs added in April. The market was expecting just 185k. That gives us a 12-month average of 218k, well above pre-financial crisis average monthly job growth! The unemployment number was 3.6% — the lowest since 1969.

Remember, we’ve been told all year long that we were headed for both earnings and economic recession. It’s not happening.

Moreover, the two missing pieces of the economic recovery puzzle, have been productivity and wage growth. And these pieces are emerging. Wage growth has been on the move for the past 18 months, now sustaining above 3%. And we had a huge positive surprise in productivity this week.

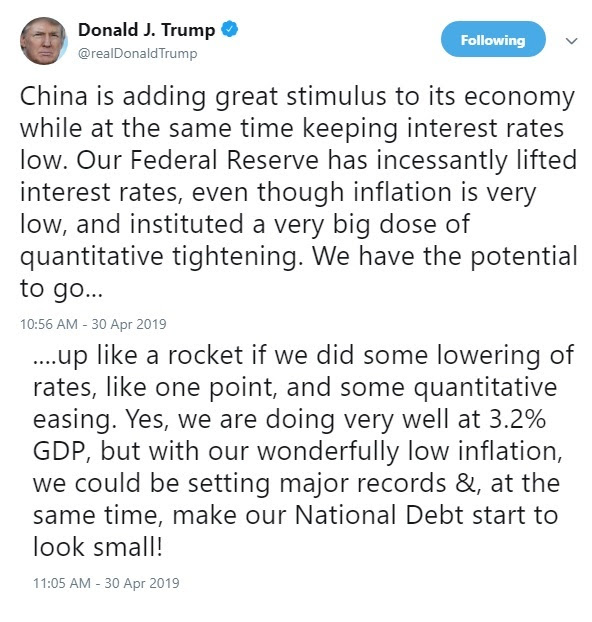

With the above in mind, given the contrast of media narrative and reality, how are people getting it so wrong? I suspect we are seeing plenty of people make the mistake of letting politics cloud their judgement on the economy and the outlook for stocks.