|

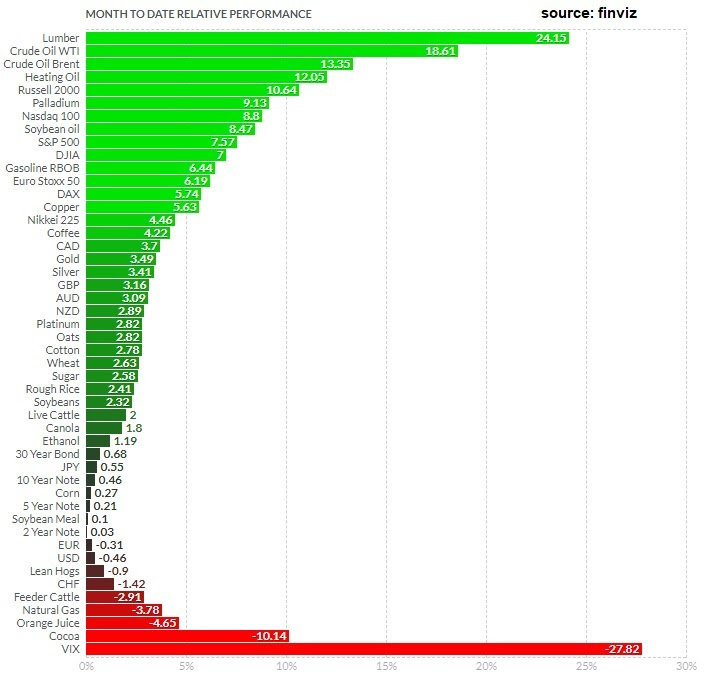

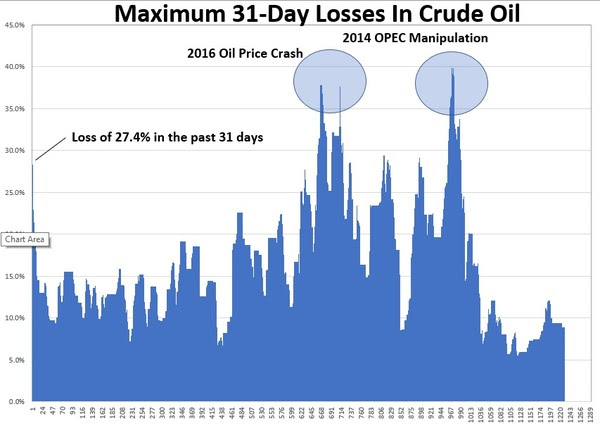

June 12, 5:00 pm EST Remember, last week we talked about why $50 is a very important level for oil. A recent Dallas Fed survey has the breakeven level for shale producers at $50. In other words, the shale industry needs oil prices above $50 to produce profitably. If the shale industry becomes unprofitable, that becomes a problem. As we found in 2016, when oil prices crashed, the shale industry became vulnerable. Defaults started lining up in the industry, which made banks vulnerable. When banks are vulnerable, credit tends to tighten and the financial system can quickly become unstable. Now, as we know, the price of oil bounced from that $50 area last week, but we’re getting another test today. Oil was the mover of the day — down close to 4%, and back under $51. This, I suspect, will play a very important role in the Fed decision next week. Despite the fact that expectations point to a rate cut in July, we’ve discussed the pressures building that might lead the Fed to move next week (which would be a big surprise for markets). Oil plays into that scenario. Stocks and crude oil have been two clear influences on Fed policy over the past few years. The latter weighs on inflation. While the Fed claims to ignore the influence of food and energy in their inflation measure, they have a history of acting when oil moves sharply. On that note, oil is down 22% over the past year. And, again, we’re testing an important level that can have spillover effects into the economy. That’s why a sharp decline in oil prices tends to influence stocks. That’s why the charts of stocks and oil have tracked so closely …

|

|

|

So, we’ve had a nice bounce in stocks over the past week or so. We had the same for crude. But now crude is back testing the lows of this decline.

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential. Join now and get your risk free access by signing up here. |