|

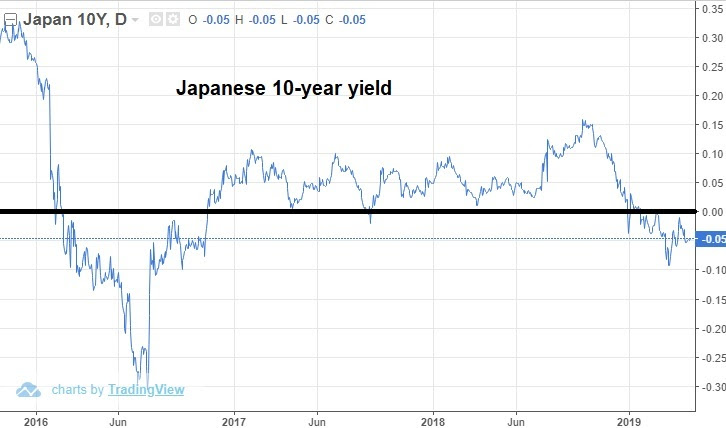

May 28, 5:00 pm EST We head into the last week of May, with major global stock markets down in the neighborhood of 5% for the month. And with major global interest rates at the lowest levels since late 2016-2017. With this in mind, let’s revisit how we opened the month of May. On May 1, U.S. stocks had just put up the best opening four months since 1999. But the interest rate market was continuing signal that the Fed had made a mistake in its rate hiking campaign — specifically the December rate hike. On a related note, we closed the first day of May with a sharp sell off in stocks, and we looked at this chart …

|

|

|

As you can see, the S&P 500 put in a big technial reversal signal — a bearish outside day. With this technical setup, I said in my May 1 note: “you have to ask the question: Can stocks force the hand of the Fed, again?” … i.e. can a lower stock market force the Fed to cut rates — to take back the December mistake. Here we are, twenty-seven days later, and stocks are down about 5%. That reversal signal did indeed predict the decline. But the decline hasn’t been messy like the slides of the fourth quarter. It has been orderly, and I suspect it’s not forcing the Fed’s hand. But, what may force the Fed’s hand is the the bond market. Consider this, the last time U.S. 10-year government bond yield was at these levels, 2.25%, the Fed Funds rate was HALF of current levels (1.25% in Q3 of 2017 versus 2.5% today). This disconnect between what the market judges to be the appropriate interest rate and what the Fed judges the appropriate level, is causing the dreaded yield curve inversion signal that is scaring markets. If things stay here, that’s probably good enough for a June (19) rate cut. If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential. Join now and get your risk free access by signing up here. |