|

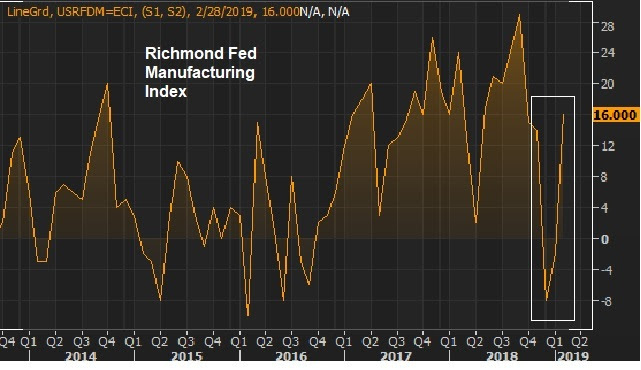

February 26, 5:00 pm EST Jay Powell (the Fed Chair) is on Capitol Hill this week, giving his semi-annual testimony to Congress. He reported today to the Senate Banking, Housing and Urban Affairs Committee. Tomorrow he will sit before the House Financial Services Committee. Remember, it was on January 4th that the Fed marched out Powell, Yellen, and Bernanke at an economic conference to reset the market expectations on monetary policy (moving from a four rate hike forecast for 2019 to a ‘wait and see’ approach). In response to the stock market drubbing of December, it was a clear message that the Fed is done raising rates. With that, there was nothing new today (nor should there be tomorrow, from Powell). The Fed will do whatever it takes to keep the economic recovery going. At the moment, that means promoting stable, low rates and a flexibility to do whatever is necessary. Remember, we’ve talked in recent weeks about some of the negative economic data hitting (from December), that reflects the souring of economic sentiment from the sharp December decline in stocks. But as I said, given the sharp V-shaped recovery in stocks we’ve seen since, we should “expect this data to bounce back just as sharply.” We’re getting a taste of it this morning. February manufacturing data from the Richmond Fed came in with a huge positive surprise. And the consumer confidence index followed a decline in January with a big upside surprise in February. We have a V in stocks. And you can see the V in the data … |

|

|

We’ll get the first look at fourth quarter GDP on Thursday (which will later be revised twice). The market has been looking for 2.5% which would give us better than 3% growth for the full year 2018. That’s “trend growth.” And for perspective, for those unable to block out the media and political noise, that’s nearly DOUBLE the average growth of the past ten years. Join me here to get my curated portfolio of 20 stocks that I think can do multiples of what broader stocks do, coming out of this market correction environment. |