Fewer And Fewer Reasons To Doubt The Stock Market Bull

May 8, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

For the skeptics on the bull market in stocks and the broader economy, the reasons to worry continue to get scratched off of the list.

For the skeptics on the bull market in stocks and the broader economy, the reasons to worry continue to get scratched off of the list.

Brexit. Russia. Trump’s protectionist threats. Trump’s inability to get policies legislated. The French election.

The bears, those looking for a recession around the corner and big slide in stocks, are losing ammunition for the story.

With the threat of instability from the French election now passed, these are two of the more intriguing catch-up trades.

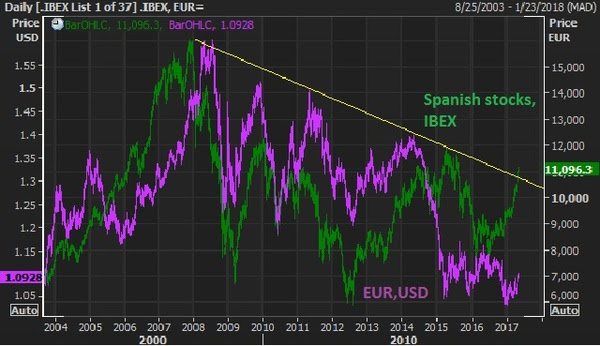

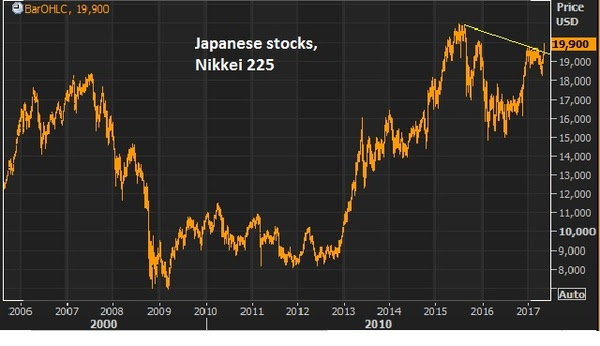

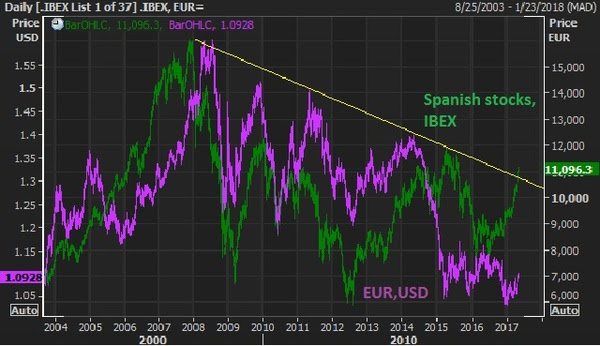

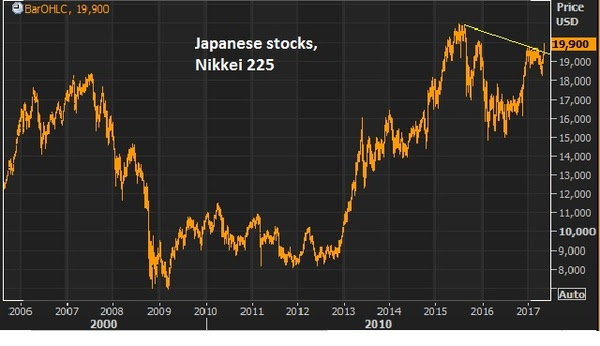

In the chart above, the green line is Spanish stocks (the IBEX). U.S., German and UK stocks have not only recovered the 2007 pre-crisis highs but blown past them — sitting on or near (in the case of UK stocks) record highs. Not only does the French vote punctuate the break of this nine year downtrend, but it has about 45% left in it to revisit the 2007 highs. And the euro, in purple, could have a dramatic recovery with the cloud of French elections lifted, which was an imminent threat to the future of the single currency.Next … Japanese stocks. While the attention over the past five months has been diverted toward U.S. politics and policies, the Bank of Japan has continued with unlimited QE. As U.S. rates crawl higher, it pulls Japanese government bond yields with it, moving the Japanese market interest rate above and away from the zero line. Remember, that’s where the BOJ has pegged the target for it’s 10 year yield – zero. That means they buy unlimited bonds to push the yield back down. That means they print more and more yen, which buys more and more Japanese stocks.

The Nikkei has been one of the biggest movers over the past couple of weeks (up almost 10%) since it was evident that the high probability outcome in the French election was a Macron win.Again, German, U.S., and UK stocks are at or near record highs. The Nikkei has been trailing behind and looks to make another run now, with 25,000 in sight.If you need more convincing that stocks can go much higher, Warren Buffett reiterated over the weekend that this low interest rate environment and outlook makes stocks “dirt cheap.” Last year he made the point that when interest rates were 15% [in the early 1980s], there was enormous pull on all assets, not just stocks. Investors have a lot of choices at 15% rates. It’s very different when rates are zero (or still near zero). He said, in a world where investors knew interest rates would be zero “forever,” stocks would sell at 100 or 200 times earnings because there would be nowhere else to earn a return.

Buffett essentially said at zero interest rates into perpetuity, the upside on the stock market (and any alternative asset class with return) is essentially infinite, as people are forced to find return by taking risk. Why you would buy a treasury bond that has no growth, and little-to-no yield and the same or worse balance sheet than high quality dividend stock.

This “forcing of the hand” (pushing investors into return producing assets) is an explicit objective by the interest rate policies of the Fed and the other major central banks of the world. They need us to buy stocks. They need us to spend money. They need economic growth.

If you have an brokerage account, and can read a weekly note from me, you can position yourself with the smartest investors in the world. Join us in The Billionaire’s Portfolio.

For the skeptics on the bull market in stocks and the broader economy, the reasons to worry continue to get scratched off of the list.

For the skeptics on the bull market in stocks and the broader economy, the reasons to worry continue to get scratched off of the list.