|

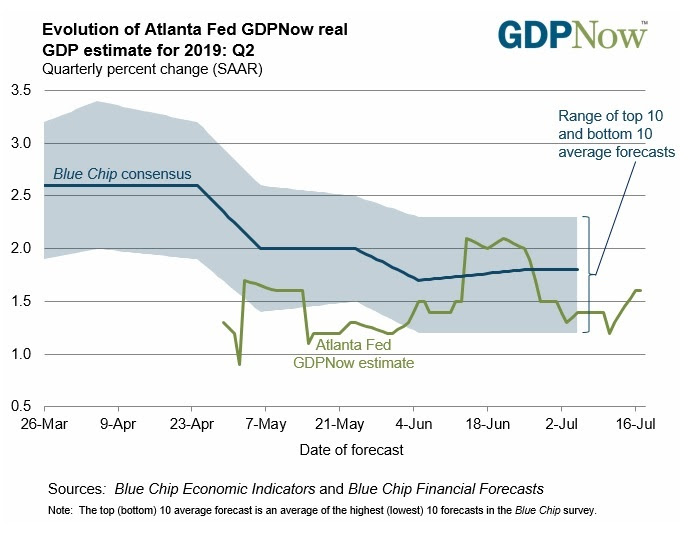

July 17, 5:00 pm EST With Bank of America earnings today, we’ve now heard from all of the big four banks (JPM, BAC, WFC and C). We’ve had positive earnings surprises in each, for an average earnings growth of 21% for the group. That’s 21% yoy earnings growth for the biggest banks in the country, in a quarter where the broader market is expected to shrink earnings by 3%. The positive surprises in bank earnings have been driven by the consumer business. And keep in mind, the consumer (personal consumption) makes up 70% of the U.S. economy. Perhaps Q2 will turn out better than the sub 2% growth expected by economists. The first reading on Q2 growth is due to be reported next Friday. Here’s what the Atlanta Fed model on GDP growth looks like, as we continue to get Q2 data incorporated, going into the first GDP reading … |

|

|

Remember, back in April, the first look at Q1 GDP came in as a huge positive surprise (at 3.2%). Many were expecting it to be a terrible quarter. Goldman Sachs thought the quarter would produce just 0.7% growth. They were wrong, and they weren’t alone. At the end of the first quarter, the Atlanta Fed’s GDP model was estimating that the economy grew at only 0.3% in Q1.

If you haven’t signed up for my Billionaire’s Portfolio, join now — get your risk free access here.

|