Don’t Forget, BOJ Is Still Stoking Global Markets Through QE

|

May 15, 5:00 pm EST

The bounce for stocks continued today. But global yields were broadly weak.

Why? Is this a market that’s pricing in more global central bank easing (therefore lower rates, higher asset prices)?

It might appear that way. Trump has been asking for a rate cut. In fact, yesterday he tried to make the case for more QE (let’s assume he means ending the Fed’s balance sheet reduction program). The fed funds futures market has been pricing in a rate cut for a while now — now looking for a 50% chance of a cut by September and a 75% chance of a cut by year end.

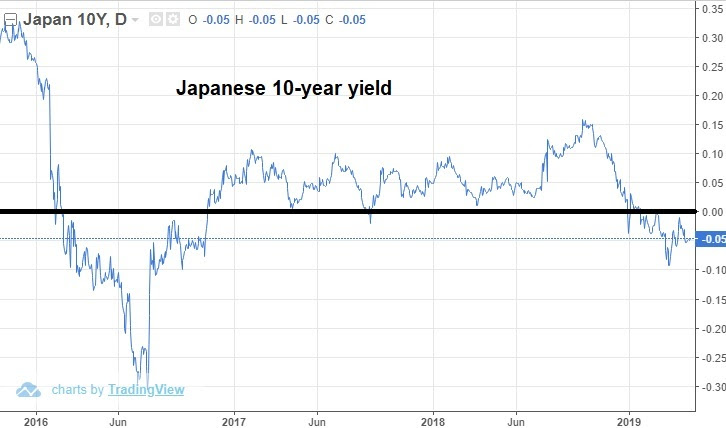

Additionally, the German 10-year yield hit the lowest level since 2016 — negative 10 basis points. And the Japanese 10-year yield traded down to negative 5 basis points today (chart below).

|

|

Now, as you can see, the 10-year in Japan has been back in negative yield territory all year — and sustainably, for the first time since 2016.

The last time rates were down here, the BOJ added some wrinkles in their QE plan. Instead of targeting a size of asset purchases, they began targeting a zero yield on the Japanese government bond. So, as long as the yield is positive in Japan, the Bank of Japan has the mandate to buy unlimited assets (print unlimited yen) to push the yield back to zero. They already own half of the JGB market. So, how can they influence yields higher from here? They can sell JGB’s. What might they do with those proceeds? Buy global stocks?

If you haven’t signed up for my Billionaire’s Portfolio, don’t delay … we’ve just had another big exit in our portfolio, and we’ve replaced it with the favorite stock of the most revered investor in corporate America — it’s a stock with double potential.

Join now and get your risk free access by signing up here.

|

|

|

|

|