May 11, 2017, 4:00pm EST Invest Alongside Billionaires For $297/Qtr

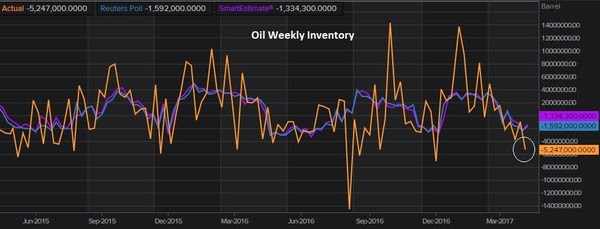

| Oil has been on the move the past few days. Was this recent dip a gift to buy?The oil inventory report yesterday showed a big drawdown on oil inventories. The market expectation was for about a drawdown of 1.5 million barrels. It came in at 5 million.

That has oil on a big bounce for the week. It’s trading about 8% higher than it was at the lows of last Friday. But we still sit below the 200 day moving average and below the key $50 level (the comfort zone for those producers, namely the shale industry, to fire back up idle capacity). The weakness in oil has a lot to do with weakness across broader commodities. And broader commodities typically correlates well with what Chinese stocks are doing.

You can see in the chart above, how closely the two track. This bottom in commodities has/had everything to do with the outlook for a big infrastructure spend out of the Trump administration. It’s yet to bubble up toward the top of the action list. With that, the momentum has either stalled on this trade, or it’s a pause before another leg higher in this early stage multi-year rebound. My bet is on the latter. In our Billionaire’s Portfolio, we have a stock in our portfolio that is controlled by one of the top billion dollar activist hedge funds on the planet. The hedge fund manager has a board seat and has publicly stated that this stock is worth 172% higher than where it trades today. And this is an S&P 500 stock! Even better, the company has been constantly rumored to be a takeover candidate. We think an acquisition could happen soon as the billionaire investor who runs this activist hedge fund has purchased almost $157 million worth of this stock over the past year at levels just above where the stock is trading now. So we have a billionaire hedge fund manager, who is on the board of a company that has been rumored to be a takeover candidate, who has adding aggressively over the past year, on a dip. Join us today and get our full recommendation on this stock, and get your portfolio in line with our BILLIONAIRE’S PORTFOLIO. |